This post was written by Teddy Woodhouse, Research Manager for Access and Affordability, A4AI

Despite the fact that half the world’s population uses the internet and the global digital economy has grown into a US$13 trillion industry, only 28% of Africans are online. Closing the digital divide remains as urgent as ever. More competition in mobile internet could play a fundamental role in achieving that.

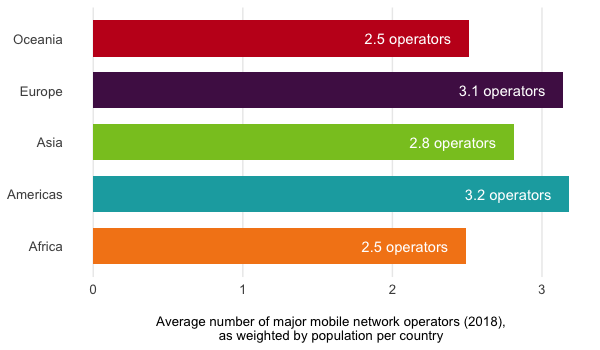

For years, Africans have had fewer choices for mobile internet. On average, Africans have just 2.5 network operators to choose from for their internet access. This compares against higher rates in all other regions – as high as 3.2 operators in the Americas.

Africa and Oceania are the only continents without a single country that had four major mobile broadband operators in 2018. Oceania’s island geography can explain this: but this lack of competition in Africa has real but surmountable consequences for users.

This lack of competition also comes with the world’s most expensive internet, the lowest 3G and 4G coverage rates, and slowest speeds. As mobile internet spreads across the globe, millions of people are being left behind with connectivity that’s too expensive to buy, too limited in coverage, or too slow to use.

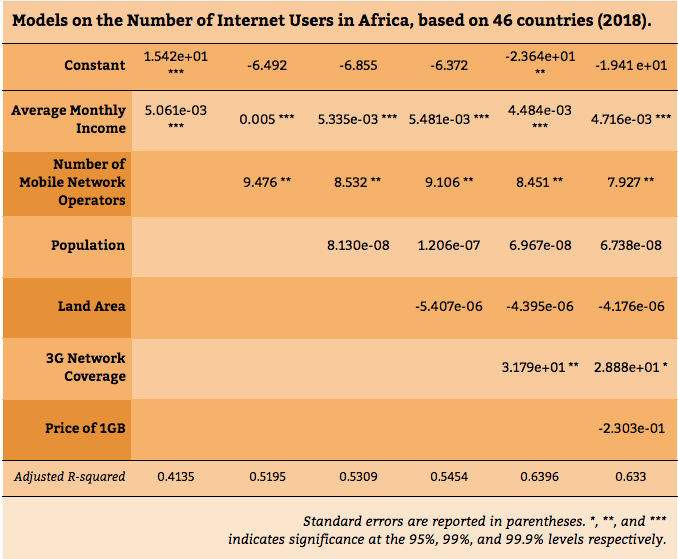

The 2019 Affordability Report demonstrates the positive effects of market competition on driving down internet prices across low- and middle-income countries. Based on data from that report, we also find that, in Africa, the addition of a second or third major mobile network operator into consolidated markets could bring an estimated additional 8% online with each addition.

Based on this model and controlling for changes in population, network coverage, and average incomes, the expansion of three-operator markets across Africa could bring an estimated 59.4 million people online – including 44 million people in low-income countries. As a population, this would be roughly the same size as the entirety of South Africa coming online.

Of course, this is not an overnight change, and simply granting a new license or two will not solve systemic problems. To build markets that can sustain robust, sustainable, three-operator competition, governments must adopt fair market rules, evidence-based policies, and a dynamic competition policy as shown in the steps below.

Policymakers across Africa have an important moment to catalyse their markets, encourage innovation, and drive down prices for consumers with greater competition. Opportunities like the planned granting of two additional licenses in Ethiopia are rare – and must be done prudently. Competition also comes from beyond just the mobile broadband market – community and co-operative networks add to a healthy and diverse digital ecosystem. The decisions made could mean connectivity or continued isolation for millions of people across the continent.

For more updates on our work, follow us on Twitter at @a4a_internet.

Leave a Reply