2019 Affordability Report

i

Welcome

Welcome to the 2019 edition of the Affordability Report! This year’s report calls on policy makers and regulators to promote competitive and diverse broadband markets as key ingredients to drive down the cost of internet access. With new analysis and insights to inform policy action, this year’s report is accompanied by five impact stories. From Grace in Cape Town to Francisco in Mexico and Anita in Cameroon, we share the stories of how policy actions indeed impact human life.

Competitive and diverse markets, especially those with robust public access options, emerge as a path forward for increased inclusion and the expansion of digital economies. Our analysis also shows a very encouraging trend in low-income countries’ policy progress towards affordability. The report outlines several key actions governments can take to ensure the health of markets in their countries. Beyond regulation, we note that policy makers should prioritise public investment strategies such as open access wholesale networks and public access solutions — all key elements of A4AI’s Good Practices Policy Framework. To support the analysis and recommendations, we share a number of case studies highlighting the lessons learned in specific country examples.

As we continue to advocate for improved policy frameworks, it is clear that we need to raise the bar on internet access. Despite progress, far too many people remain offline, mostly in low- and middle-income countries. Even among those connected, there is a wide disparity in the quality of internet they access. To address this gap, we recently introduced Meaningful Connectivity, a new measurement standard to encourage policymakers to target both improved quality of service and expansion of access. By designing policies that support market growth and expansion, and developing initiatives to secure equal and affordable access where the market does not see commercial viability, governments can make affordable and meaningful connectivity a reality for everyone.

Across the globe, we have seen the impact of good policy practices in action. To share these experiences and lessons learned, A4AI has launched a Good Practices Database. From the Kenyan government’s elimination of taxes on handset purchases to Costa Rica’s national plan for universal connectivity, these case studies aim to support policy makers and all stakeholders in their work to bring down the cost to connect and expand access. While we continue to grow this database of policy good practices, we look forward to your feedback and welcome suggested examples to add to this public resource.

We hope you enjoy and learn from this 2019 Affordability Report and these other new resources. We invite you to join us on this journey towards digital equality. Become a member of our global coalition to be part of our research and policy advocacy work. Together, we can make access to the internet affordable and meaningful for all.

Sonia Jorge

Executive Director, Alliance for Affordable Internet

ii

Executive Summary

Internet access should not be a luxury. Not only a pathway to information, communication, and economic opportunity, the internet is increasingly necessary to access basic commercial and public services. As more of the world becomes digital, those unable to connect will be left behind. It is therefore crucial that everyone has the opportunity to get online.

For the 50% of the world unable to connect, the greatest barrier remains affordability. Across Africa, the average cost for just 1GB data is 7.12% of the average monthly salary. In some countries, 1GB costs as much as 20% of the average salary — too expensive for all but the wealthiest few. If the average US earner paid 7.12% of their income for access, 1GB data would cost USD $373 per month! This gulf underlines the challenge we have to bridge the global affordability gap and ensure that everyone has affordable internet access.

The Affordability Report looks at the policy progress low- and middle-income countries are making to support affordable internet access. This year it explores how governments can shape healthy, competitive markets supported by public access solutions to deliver affordable and meaningful connectivity to everyone.

Competitive markets lead to affordable internet access

The Affordability Drivers Index (ADI) measures government policies that impact internet affordability. This year’s index shows that:

- Low-income countries made impressive strides towards affordability: In this year’s ADI, low-income countries increased their scores three times as much as middle-income countries, on average. As a group, low-income countries saw a 15.6% increase in their ADI score from 2018 to 2019: this compares to 4.5% and 5.1% for lower-middle and upper-middle-income countries, respectively.

- Competition is core to successful broadband markets: Our analysis shows that healthy market competition leads to more affordable internet access, giving consumers choices and adding competitive pressure to lower prices. Conversely, a lack of competition is one of the biggest barriers to affordability. Our analysis estimates that consumers in countries with consolidated markets pay USD $3.42 more per GB for mobile data than those in similar countries with healthy markets. Policymakers and regulators must work to encourage competition and support new entrants to enter their markets.

- Public access options are vital to strengthening markets: While promoting competitive markets should be governments’ top priority, competition only goes so far. Markets should be complemented with public access options such as free public Wi-Fi and telecentres to fill gaps in the market and add further competitive pressure.

While it is clear that competition is core to the success of broadband markets, many countries are falling short. Of the 136 low- and middle-income countries studied in this report, only 65 have fully competitive markets. Globally, over 260 million people have just one choice of major mobile network operator, and an estimated 589 million people live in countries where a lack of competition keeps internet prices higher than they should be. While there is a historic trend towards liberalisation, this year’s report shows that progress on market competition is stalling and, in some cases, markets are becoming more consolidated. For example, international telecoms company Millicom exited from African markets, threatening a wave of consolidation across the continent. In India, operator Reliance Jio — which was once a disrupting force bringing millions online via mobile internet — is now rapidly consolidating the market.

Governments can support healthy broadband markets

Governments should use their policy and regulatory powers to build competitive broadband markets that provide users with lower costs and high quality services. They should focus on three core areas necessary to support healthy, competitive markets:

- Shaping a competitive market environment for broadband

In robust and competitive markets, operators face more pressure to innovate and provide value. Governments can help by setting fair and clear market rules for entry into the market, with clear licensing requirements for traditional providers and community networks. Policymakers should support robust operating rules, and regulators should provide regulatory certainty for service providers to help their long-term planning and to encourage network investments. They should intervene where necessary but, most importantly, must establish incentives to ensure market environments continue to support competition. With the telecommunications landscape constantly changing, the International Telecommunications Union’s (ITU) proposed concept of collaborative regulation is particularly critical, supporting policy innovation to address threats to competition as they evolve.

- Supporting affordable backhaul and infrastructure

Access to backhaul connectivity must be affordable so that additional service providers are able to enter the market, providing more competition. Regulators and policymakers play a key role in facilitating infrastructure sharing among operators, investing in high-capacity backhaul networks, and allocating spectrum in a fair and transparent way.

To help make connectivity more affordable for providers at the wholesale level, a growing number of governments are trialling investments in wholesale open access networks (WOANs). An examination of trials in Mexico and Rwanda, where WOANs are most developed, suggests they could offer a viable option to countries with low connectivity and consolidated broadband markets that are in need of substantial reform.

Case Study

Submarine competition in Ghana. As demand for internet access across West Africa first explodes, a public-private partnership in Ghana adds competition at the backhaul level and triggers a drop in internet prices. Read more »

- Investing in public access options to complement markets

Public access and community networks complement the commercial market. They supply access where there are market gaps, expand connectivity to more people, build digital skills in new communities, and cultivate demand for internet access. They can also increase competition by providing more choice to consumers, which adds pressure for operators to improve services and lower prices. Governments should invest in public access as a priority.

Snapshot

Public access changing lives. See how public access internet has improved the lives of an Indonesian mango seller and a university cleaner in Cape Town, South Africa. Read more »

Market competition and public access options are powerful, complementary forces that motivate providers to innovate and provide affordable, quality services for users. Governments should use their regulatory powers to support a competitive market environment as well as invest to open up markets to new providers and end users. By taking these steps to shape healthy, stable broadband markets, governments will help more citizens get online with affordable internet access.

1

The state of internet affordability

The world remains years, if not decades, away from achieving universal, affordable internet access. The stubborn digital divide mirrors wider inequalities that divide the world’s population today: income, gender, location, and education are highly predictive of whether an individual has access to and can regularly use the internet. Closing this divide holds enormous economic and social benefits. As stakeholders across the telecommunications sector work towards this effort, the Affordability Drivers Index aims to guide policy discussions towards more affordable and more reliable connectivity for as many as possible.

KEY INSIGHTS

- Infrastructure investments explain this year’s major improvements, moving some countries to higher positions on the Affordability Drivers Index (ADI).

- The two most improved countries in this year’s ADI, Cameroon and Mali, both adopted new national broadband plans.

- Overall, broadband policy change falls short of what’s needed to reach international targets for universal access.

Affordability Drivers Index 2019

The ADI is a tool developed by the Alliance for Affordable Internet (A4AI) to assess how well a country’s policy, regulatory, and overall supply-side environment is positioned to lower industry costs and ultimately create more affordable broadband.

The ADI does not measure actual broadband prices, nor does it tell us how affordable broadband is in a given country. Instead, it scores countries across two main policy groups:

Infrastructure — the extent to which internet infrastructure has been deployed, as well as the policy framework in place to encourage future infrastructure expansion; and

Access — current broadband adoption rates, as well as the policy framework in place to enable equitable access.

High ADI scores correlate with reduced broadband costs on both the industry side and for consumers. As Figure 1 shows, there is a negative and statistically significant correlation between a country’s ADI score and the affordability of a 1GB mobile prepaid broadband plan — reaffirming that improving policies and regulations to lower industry costs should be a priority for all, and particularly for low- and middle-income countries.

The top performers in this year’s Affordability Drivers Index are unchanged since 2018 aside from Costa Rica, which passed Peru to reach third place after a large jump in smartphone adoption and extensive investments in its backhaul infrastructure, and Thailand, which moved ahead of India into eighth position due to large increases in international bandwidth per user — with more bandwidth on the way. India’s advances on the ADI’s Access Sub-Index — which measures both broadband availability and the policy environment to support broadband access in a country — were softened by the country’s quickly consolidating mobile market.

| Top 10 Countries | |||

|---|---|---|---|

| 1 |  Malaysia (-) Malaysia (-) |

6 |  Turkey (-) Turkey (-) |

| 2 |  Colombia (-) Colombia (-) |

7 |  Argentina (-) Argentina (-) |

| 3 |  Costa Rica (+1) Costa Rica (+1) |

8 |  Thailand (+1) Thailand (+1) |

| 4 |  Peru (-1) Peru (-1) |

9 |  India (-1) India (-1) |

| 5 |  Mexico (-) Mexico (-) |

10 |  Dominican Republic (-) Dominican Republic (-) |

| Top 10 (Low income only) | Top 10 Risers | ||

| 1 |  Benin (29th) Benin (29th) |

1 |  Cameroon (44th, +6) Cameroon (44th, +6) |

| 2 |  Rwanda (31) Rwanda (31) |

2 |  Mali (40, +5) Mali (40, +5) |

| 3 |  Tanzania (32) Tanzania (32) |

3 |  Philippines (26, +5) Philippines (26, +5) |

| 4 |  Uganda (36) Uganda (36) |

4 |  China (35, +5) China (35, +5) |

| 5 |  Nepal (39) Nepal (39) |

5 |  Kazakhstan (48, +3) Kazakhstan (48, +3) |

| 6 |  Mali (40) Mali (40) |

6 |  Jordan (18, +3) Jordan (18, +3) |

| 7 |  Mozambique (45) Mozambique (45) |

7 |  Tanzania (32, +3) Tanzania (32, +3) |

| 8 |  Burkina Faso (49) Burkina Faso (49) |

8 |  Tunisia (21, +2) Tunisia (21, +2) |

| 9 |  The Gambia (50) The Gambia (50) |

9 |  Namibia (42, +2) Namibia (42, +2) |

| 10 |  Malawi (52) Malawi (52) |

10 |  Bolivia (30, +2) Bolivia (30, +2) |

Improvements among low-income countries

The most positive trend in this year’s ADI is the progress made by low-income countries. These countries, on average, improved their scores three times as much as middle-income countries, with a 15.6% increase from 2018 to 2019, compared to just 4.5% and 5.1% in lower-middle and upper-middle-income countries, respectively. In absolute terms, low-income countries rose by 3.2 points on average, while middle-income countries rose by 2.6 points. This means that low-income countries made the most improvements in terms of lowering broadband industry costs.

Policies driving progress

A diverse range of policy changes and infrastructure investments have led to improvements in a number of countries. New national broadband plans (NBPs) in Cameroon and Mali led both to the top of the list of most improved countries. Policy changes in the Philippines, such as the introduction of mandatory public consultations in regulatory decision-making, and in China, with the adoption of mobile number portability, placed both countries among the top improvers. Market growth for mobile internet moved other countries up the Index: large expansions of 3G coverage in Mali, Sierra Leone, and Tanzania; mobile internet subscriptions in Kazakhstan; and overall internet use in Namibia were all influential factors in this year’s assessment.

Slow progress overall

While there were bright spots of progress, these were generally the exception in this year’s Index. The stagnant pace of broadband policy change leaves millions unable to access the internet due to cost, coverage, and other reasons. The Affordability Drivers Index continues to correlate strongly with overall affordability of mobile broadband and provides policymakers with guidance on policy practices and regulatory interventions to improve broadband services in their countries.

Figure 1. Correlation of ADI 2019 and mobile broadband affordability for 2018

This year’s report looks at the impact that market conditions have on internet affordability and how policy and regulation can drive healthy, competitive broadband markets. There is a correlation between performance on the ADI and higher market competition, with countries that perform well on this year’s Index also having some of the most competitive markets. Meanwhile, many countries with low scores have mobile broadband monopolies. This relationship holds even when we control for factors such as average income, population, handset costs, and literacy. This relationship encourages further research into the influence of market competition on internet affordability.

2

How broadband markets affect affordability

Market competition and composition remain prominent themes in broadband regulation and, as our analysis shows, is one of the most important factors impacting affordability. While there has been a historic trend towards liberalisation, the progress towards market competition is stalling and, in some cases, markets are becoming more consolidated.

The exit of international operator Millicom from African markets has engendered a wave of consolidation across the continent. In India, operator Reliance Jio — which was once a disrupting force bringing millions online via mobile internet — is now rapidly consolidating the market. There has also been consolidation in Europe, with regulators recently approving a string of mergers, from five to four major operators (Austria, the Netherlands, the UK) and from four to three (Ireland, Germany; and again in Austria and the Netherlands). This trend underlines the urgency of promoting competition to support healthy markets that provide affordable internet access.

KEY INSIGHTS

- Market competition is one of the most influential factors for the price of mobile data.

- Poor broadband policy that fails to foster a healthy, competitive market costs users an estimated $3.42 per GB.

- Breaking up a broadband monopoly can create a savings of up to $7.33 per GB for users.

- Policymakers and regulators must play a role in supporting healthy broadband markets.

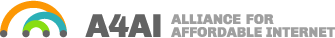

Figure 2. Mobile Broadband Market Competition, as HHI

What is market competition, and how do we define it?

Market competition relates to the number of providers in the market and the size of their market share. This report relies on the widely used and respected Herfindahl-Hirschman Index (HHI) to analyse and compare different markets. The HHI is calculated by adding together the squares of each operator’s mobile broadband market share. Higher numbers (going up to 10,000) represent more concentrated markets; lower numbers indicate more competitive markets.

Understanding broadband and its markets

The internet has multiple layers. When someone uses a mobile phone, tablet, or computer, that device sends and receives data through a variety of networks and cables. Some pieces are high-capacity — such as the submarine cables that connect continents — while other networks exist at a smaller scale, like the domestic network that connects an internet exchange point (IXP) to a mobile tower or a community network that connects a rural region. These parts function in technical cooperation as the internet as a whole but also exist in different layers of economic competition.

Snapshot

Community networks can play an essential role in providing reliable connectivity in rural and remote areas. This connection became a lifeline for one taxi driver’s business in Mexico. Read more »

|

|

|

||

|---|---|---|---|---|

| Also known as ‘backhaul’, this includes the submarine cables and international bandwidth across countries and between cities and IXPs. | The parts of the domestic network that connect smaller towns and key public institutions with the first mile. | Closest to the user, this part of the internet includes a neighborhood’s network and the connection between a tower and someone’s mobile phone. | ||

Each layer of the internet has its own market. A user will pay an internet service provider (ISP) for their connection. That ISP will pay other network operators interconnection fees to plug into the domestic network. A network operator will pay a fee to a submarine cable company for international connectivity. If a user pays $2 for 1GB of mobile broadband, fractions of that retail price will pay for various interconnection fees across layers of the internet. The amount of competition at each of these levels affects the price that a user pays. A high fee at the first mile, for example, can trickle down to increase the price an individual user pays.

Technological innovation creates regular opportunities for market shifts. As mobile broadband technology has developed and become more ubiquitous across the globe, markets have also become more competitive. This makes sense: with more demand, greater supply — in the form of more bandwidth and more operators — has followed. This has benefited consumers, because a larger mobile broadband market typically offers more options and more reliable connections. Policymakers and regulators should continue to encourage new technologies and policies that increase choice and competition across different layers of the internet.

Market competition supports affordable access

Broadband policies that promote market competition incentivise operators to compete for customers on price, coverage, and quality of service. Recognising this, the ADI includes a number of indicators on market competition. Countries with greater market competition and policies such as mobile number portability — which supports consumer choice — perform higher on the ADI.

Snapshot

“It helps me escape.” Ruth, a domestic worker in Lagos, Nigeria, switches between the networks of three operators to access the most reliable internet services available at the lowest cost. Read more »

Initial analysis from 2018 affordability data suggests that market competition has a positive and statistically significant influence on the price of a gigabyte across low- and middle-income countries. This occurs even when controlling for factors such as average income, physical geography, market size, mobile penetration, and literacy.

What is a competitive market?

Countries have varying degrees of competition in their mobile broadband markets:

Healthy markets: with robust and consistent competition;

Liberalising markets: with emerging and growing levels of competition;

Partially liberalised markets: where countries have started the process of liberalisation in mobile broadband but have seen a private operator fill the archetype of a monopoly-like structure;

Consolidation markets: where there is little or no competition or the market has seen a recent trend of consolidation; and

Early stage markets: where countries have just started the process of liberalisation.

Countries are categorised into these groups based on their recent market characteristics, primarily using the HHI measure of market competition. These categories sit on a spectrum from fully consolidated to healthy, competitive markets.

Our analysis estimates that the transition from a consolidated to a healthy broadband market could save users up to USD $3.42 per GB. Further analysis predicts that a low- or middle-income country progressing from a one-player to a two-player mobile market could see a drop of USD $7.33 per GB of mobile data. In both cases we assume all other factors, such as education, population, and income, as being equal. A lack of market competition has a high cost for users.

Despite this evidence, broadband markets in a number of countries — particularly low- and middle-income countries — still struggle with competition. Globally, over 260 million people have only one choice for a major mobile network operator that serves their area. An estimated 589 million people live in countries where a lack of competition keeps internet prices higher than they should be.

Figure 3. Number of Major Mobile Broadband Network Operators per Country

3

How governments shape broadband markets

Markets do not exist in a vacuum. They are deeply influenced by the policy environment, and the telecommunications sector is no exception. Policymakers have significant power to shape market conditions and promote broadband development.

KEY INSIGHTS

- Policymakers and regulators can promote competition by shaping the market environment.

- To support healthy competition, policymakers should prioritise fair market rules, evidence-based policies, and dynamic competition policy.

- In additional to setting regulatory vision, policymakers can drive broadband access with targeted investments.

Governments define the market environment

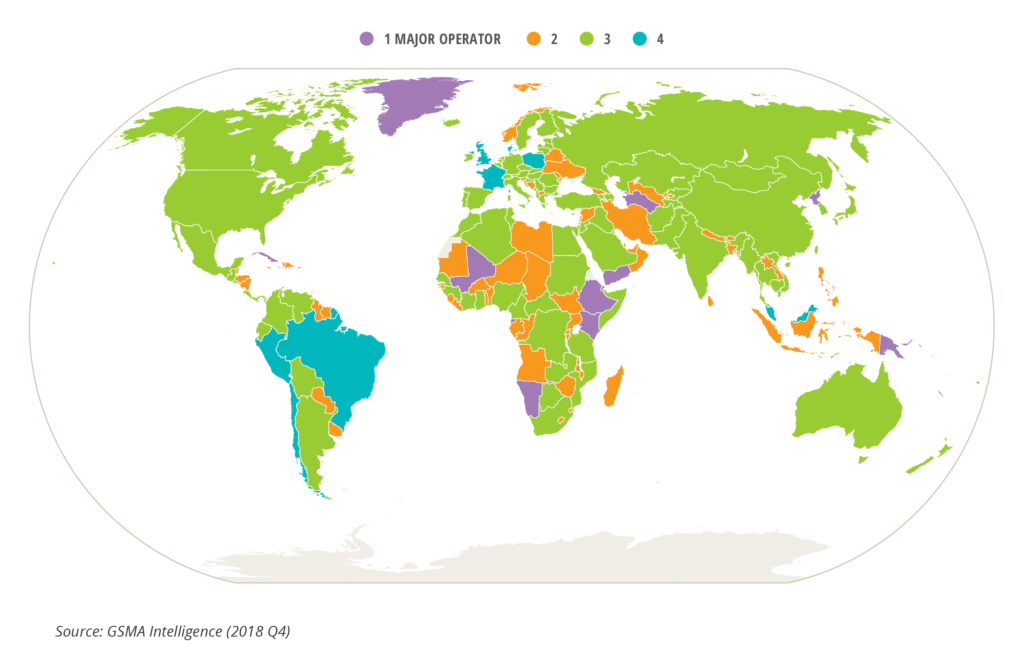

Markets change in tandem with their regulatory setting — the regulatory history of the telecommunications industry documents this relationship. The ITU Global ICT Regulatory Outlook of 2017 introduced a series of five generations of ICT regulation (Figure 4). This framework illustrates the relationship between markets and their policy environments. As regulators have transitioned from one generation to the next, the markets they regulate have changed in composition as well.

Figure 4. Summary of ITU’s Generations of Regulation

Policy can also influence how individual actors behave through the incentives it creates. For example, markets with companies that hold combined private and public capital can create dynamics that undermine fair competition. This is demonstrated in Namibia and Angola, where government investment in private operators has created a tension between the public good of a market with affordable prices and the governments’ desire for larger returns on investment. On the other hand, countries that have focused on developing open, business-friendly environments, with policies such as allowing 100% foreign ownership, have benefited from dynamic markets that are highly sensitive to consumer pressures. This approach has been crucial to the explosive growth seen in Myanmar and Cambodia.

While privatisation can lead to more competitive broadband markets with lower costs, this is not an inevitable outcome. Without accompanying regulatory reforms, a state-owned monopoly can simply become a private monopoly exhibiting the same negative behaviours. Hence, there are various paths to liberalisation and, while some improve the way markets operate, an effective regulatory framework is crucial for healthy market growth.

Regulatory strategies for supporting competition

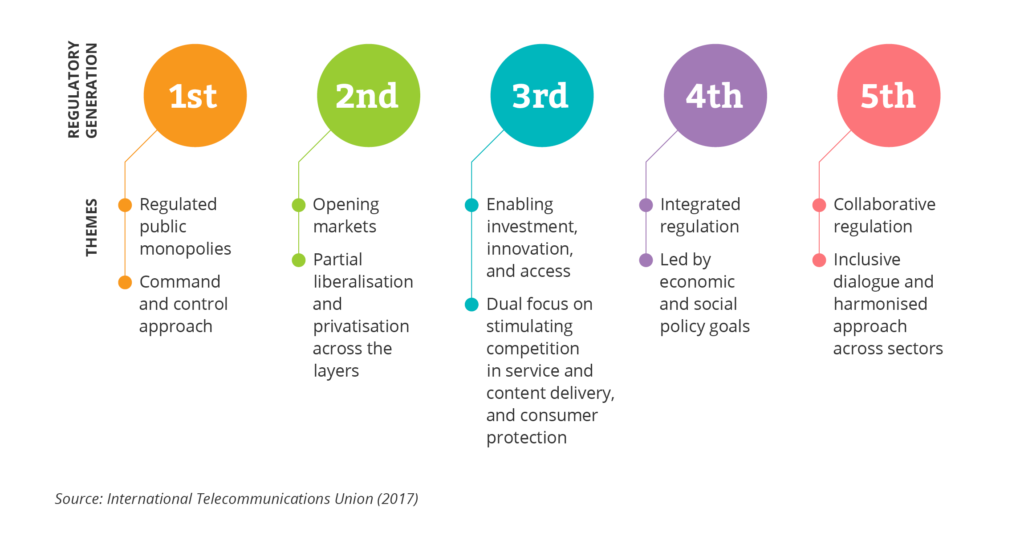

Regulators can shape the market environment to encourage new operators to enter the market and encourage healthy competition in a number of ways:

- First, they have the authority to issue rules of entry and market participation through its licensing regime and spectrum allocation practices. Such changes can make it easier for smaller enterprises to enter the market and for alternative models, such as community networks, to thrive. This promotes market diversity — an important aspect of broadband market health and resilience.

- Second, regulators should adopt consensus-based procedures that include stakeholders from across the sector and also ground decisions in strong evidence. Strong procedures give opportunities for industry and community groups to contribute to the regulatory process. In turn, this builds stakeholder trust in the regulator, its authority, and its decisions.

- Third, regulators can support industry sustainability through their long-term stewardship of the sector. They can apply a dynamic balance of catalysing interventions to promote competition when markets are stagnant while also ensuring markets are a sustainable environment for providers to operate, invest, and innovate.

By establishing rules that support a fair and open market environment, working collaboratively with stakeholders, and grounding policies in evidence, regulators can gradually build the legitimacy needed to take action, and intervene when necessary to promote healthy competition.

Figure 5. Steps for regulatory support for market competition

In addition, when consumers are empowered in competitive markets, regulatory intervention is less often needed to address market failures. A consumer’s right to keep their mobile number when they switch providers — known as mobile number portability — is a clear example of such a policy. Consumers can quickly and continuously evaluate the services operators offer in far more detail than most regulators. By allowing them to shop around to get the best deal, this policy creates competitive pressure for providers to innovate and improve their offering. Policies like these can promote higher quality of service and wider geographic connectivity without requiring regulators to take punitive action against operators.

Snapshot

People connect to the internet through a variety of connections. Learn about Wi-Fi snooping, SIM swapping, and more in Cameroon. Read more »

Healthy markets require not only competition but also regulatory stability. Whereas competition encourages innovation, unpredictable regulatory environments can reduce operator investment. Similarly, hypercompetitive markets can also lead to operators having to spend more on customer recruitment and retention, reducing the potential net investment in a country’s telecommunications infrastructure and overall coverage. With fair rules that provide operators the stability necessary to anticipate returns on investments, they have the flexibility to invest and grow the mobile broadband market.

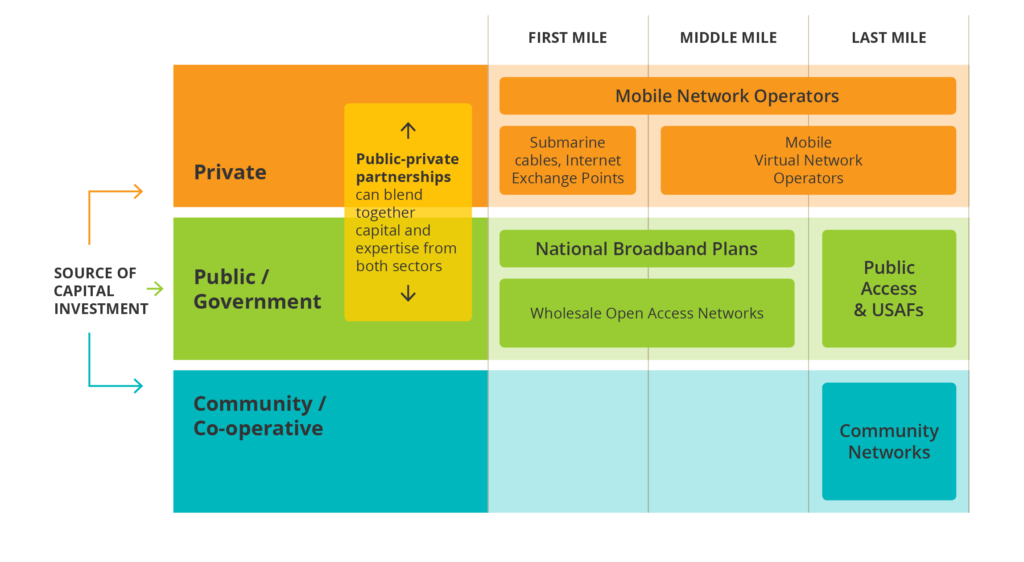

Investing in multiple parts of the internet

The telecommunications sector contains complex, multi-layered markets. This structure offers policymakers multiple points of intervention.

Figure 6. Example Investment Strategies Across Internet Layers

In addition to regulatory powers, public institutions have access to financial and political capital to drive expanded broadband access. Much of this is guided through two tools: national broadband plans, which help guide the overall development of the broadband market within a country, and Universal Service & Access Funds (USAFs), which can provide internet access according to social need rather than commercial profit. Multilateral development banks and international financial institutions often can provide expansive additional support towards this effort. Various governments have undertaken a range of investment strategies at different layers of the internet’s architecture.

The next two sections detail two of these public investment strategies. First, there is a summary of steps taken to date by policymakers to develop wholesale open access networks at the backhaul level. Then, the report considers the impact of public access programs for internet access, affordability, and market composition.

4

Building wholesale open access networks for competitive markets

Open access policies, where regulation is designed to allow competitors to access infrastructure on equal terms, are not new to regulators. The ITU reported in 2011 that over 160 regulatory authorities around the world have set some form of open access to passive telecommunications infrastructure, including the sharing of infrastructure or co-location and site sharing. The Affordability Drivers Index includes multiple indicators on infrastructure sharing policies and the amount of shared infrastructure in a country as positive factors for lowering industry costs. In recent years, a growing number of stakeholders have looked to build on this open access approach by developing wholesale open access networks (WOANs). This chapter considers some of the most advanced WOAN projects as an early survey of policy, regulatory, and economic implications.

KEY INSIGHTS

- Major infrastructure projects, including broadband, require both strong political will and substantial financial capital.

- A few countries — Mexico, Rwanda, and Peru — have begun building wholesale open access networks to spur market competition and expand connectivity.

- Extensive project investments are not ‘quick fixes’ for affordability: they require years of development and regular checkpoints for progression.

Open access strategies

WOANs are similar to other open access policies in their objective to build and offer equitable access to backhaul infrastructure. Theoretically, their benefits should similarly range from eliminating incumbent entrenchment, reducing overall capital expenditure, and risk sharing in the form of public-private partnerships. Many see such policies as a way to increase connectivity in rural and remote areas, including island countries, which are less attractive to private investment and more subject to market failures. They are also seen as a way to expand overall market competition by helping build broader digital ecosystems to sustain more digital platforms and mobile virtual network operators (MVNOs).

WOANs, however, are not without critics and have been challenged by a number of commentators. Indeed, current research offers little consensus regarding their positive impact beyond theoretical anticipations. Critics argue that incumbents might have lower incentives to invest in network upgrades. Similarly, because some of these networks are state-owned, their services can be costly due to the level of debt taken by governments to fund extensive network infrastructure. Private operators are likely to legally challenge prices charged by state-owned networks if they are lower than what the market currently charges.

Survey of network proposals

A small number of countries have explored the use of WOANs, and three countries — Mexico, Peru, and Rwanda — have begun developing such networks. Figure 6 summarises the initiatives to date.

| Country | Type of Network | Funding Source | Execution | Status |

|---|---|---|---|---|

| Kenya | Fiber | Chinese and Kenyan Governments | Private company (Huawei - Chinese) – roll-out phase Telkom Kenya public-private collaboration (Telkom Kenya) – operations and maintenance |

Network in Construction; Access Policy Proposed (2/3) |

| Mexico | 4G LTE | Various private investors and a development bank (CAF) | Private consortium (Public-Private Partnership with Altán) | Network in Construction/Operation (3/3) |

| Peru | Fiber | Universal Access & Service Fund (FITEL) | Private consortium (Azteca) | Network in Operation (3/3) |

| Rwanda | 4G LTE | South Korean telecoms firm (KT Company) | Public-Private Partnership with KT Rwanda Networks | Network in Operation (3/3) |

| South Africa | Wireless | Unfunded | A state-owned company (BBI) | Policy Proposed (1/3) |

| Source: Authors, based on OECD (2013); Deloitte (2014); GSMA (2017); Web Foundation et al (2019); Riofrío (2018 and 2019); Gillwald et al. (2016); Gilbert (2019); SA Government Gazette (2019); Burkitt-Gray (2019); The World Bank (2019a) | ||||

Projects in these five countries are at varying stages of development. Importantly, while Kenya and Peru have experience with wholesale fibre optic networks, Mexico, Rwanda, and South Africa have initiatives focused on wireless technology. Sources of funding vary, but foreign investment features strongly in all the cases, including from foreign governments and international development banks.

Kenya

Kenya’s National Optic Fibre Backbone was launched in 2007 with the second phase starting in 2014. There were initially plans to deploy a single wholesale LTE network through a public-private partnership, but there are no longer references to such access standards in government working papers.

South Africa

In 2013, South Africa Connect — the country’s broadband policy — cited open access wholesale fibre and wireless broadband networks as a way to mitigate the dominance of some vertically integrated operators. A 2016 white paper from the Department of Telecommunications and Postal Services followed, describing the creation of a wireless open access network, which would be a “public-private sector-owned and managed consortium.” The white paper was discussed at the legislative level, but the relevant bill was withdrawn in February 2019 after industry pressure. The policy reemerged in a July 2019 government gazette as part of the country’s contentious spectrum debate with preferential designation for certain bands to the proposed network.

Peru

In Peru, Law no. 29904, passed in 2012, sets out the regulations for the Red Dorsal Nacional de Fibra Óptica (RDNFO — National Fibre Optic Backbone Network) along with Decree #014-2013-MTC. Funding for the project, estimated to be US$323 million, has been supported by the country’s Universal Service Fund, FITEL, and managed by the Private Investment Promotion Agency, ProInversión. The project contract was awarded to the consortium Azteca, composed of TV Azteca and Tendai, in a public-private partnership. The network has been active since 2016 but has faced a number of issues around contracting and network pricing. The country’s regulator, Osiptel, published a 2017 report that identified a number of shortcomings and considered the possibility of nationalising the network. One proposal, allowing the consortium to offer broadband tariffs on a retail basis rather than just inter-operator backhaul, was recently adopted, following backing from the World Bank.

These projects demonstrate both the fragility and the necessity of political will to support broadband network development and underline that WOANs are not a solution for all contexts. However, they have shown more promise in Mexico and Rwanda.

Mexico’s Red Compartida

In 2013, Mexico began one of its largest constitutional, legal, and regulatory restructures in order to modernise its telecommunications and broadcasting sectors for the purpose of improving their economic competitiveness and growth. Among the core elements of this reform was the deployment of a wholesale wireless network, Red Compartida.

This network uses 90MHz of the 700 MHz band where the state retains control of the spectrum to build and operate a wholesale network under a public-private partnership model. With public sector support, the private sector partner would undertake the network’s design, financing, building, operation, and maintenance, along with commercialisation of the network’s services. The network has a progressive series of population coverage targets every two years, and, as a wholesaler, the network was designed to provide services to other suppliers and authorised entities such as mobile network operators (MNO), fixed network operators (FNO), and mobile virtual network operators (MVNO).

Throughout 2016, Mexico carried out an international public tender process that was said to be transparent and based on objective criteria and was published after extensive public consultations and scrutiny. Only two bids were submitted, one by Rivada Networks and Spectrum Frontiers and another by the then newly-formed international consortium named Altán. In early 2017, the Federal Telecommunications Institute (IFT) granted a 20-year concession to the public-private partnership formed by the Agency for the Promotion of Investment In Telecommunications (Organismo Promotor de Inversiones en Telecomunicaciones, PROMTEL) and the Altán consortium to deploy Red Compartida. Local and foreign investors, including Huawei and Nokia, provided capital resources while Promtel participated by giving access to spectrum resources and to the fibre optic network.

The Mexican regulator has set a series of rules for the public-private partnership, including the review of price plans and competitive neutrality. In order to drive competition and prevent abuse of the monopoly position of wholesale access, the project was based on a structural separation between the wholesale activities and retail activities — Altán is not allowed to sell to final customers on a retail basis.

Red Compartida began operating in March 2018 with 4G LTE technology. It consists of a wholesale telecommunications network designed to promote the efficient use of resources in the telecommunications sector, while making sure the contracted developer was obligated to cover rural populations that had low or no coverage. Ultimately, the goal is that Red Compartida will not only allow MNOs and other traditional telecom companies build upon the Red Compartida, but also any small, medium, or large business to provide internet services to a community.

The project has received harsh criticism from some. Industry voices have alleged that the market failures that justified the Red Compartida and its cost analysis were not well proven. Furthermore, there was a large opportunity cost in allocating the whole 700MHz band to a single project. This is because, as an Ultra High Frequency band, 700MHz is particularly useful for mobile coverage because it can penetrate walls and therefore provides greater coverage per cell and requires fewer towers. Many advocated for alternative market-based approaches and spectrum sharing models.

Red Compartida aims to cover 14 cities, both in metropolitan areas and rural zones, as well as 34 towns dedicated to tourism. Despite the criticism, by the end of 2018, the network was on track to exceed 50% of its agreed population coverage. Altán has issued over 15 contracts to provide wireless and mobile services based on Red Compartida infrastructure. Further, prices have dropped and the economic impact of the telecommunications sector in the economy has increased. In 2018, the Development Bank of Latin America (CAF) approved a USD $50 million loan to Altán, which is expected to help it further deliver on its commitments.

As a result of these reforms, the telecommunications sector in Mexico has been significantly transformed, with greater investment, access to services, and general quality and price. Additionally, there has been a rapid reduction in mobile network interconnection cost and a growing presence of MVNOs in the country, with 14 active by Q2 2018, with a combined active subscriber base of 1.78 million (1.53% market share). While this number is still low compared to other countries, more MVNOs are expected to enter the Mexican market on the basis that Red Compartida will not compete in retail and has further expansion planned in rural areas. There are signs that the network is creating a more competitive market — the OECD found a 12% market share decline of incumbent operators between 2012 and 2016.

Rwanda’s 4G network

There has historically been a lack of private investment in telecommunications infrastructure in Rwanda as a result of the civil conflict in the 1990s and early 2000s. The World Bank Group (WBG), in partnership with the Rwandan government, developed a Country Partnership Strategy for 2014–2020 to attract private resources to support Rwanda’s development.

Broadband deployment became a core enabler of the plan and by 2010, 3,000km of fibre-optic backbone had been deployed with government support. This network provided backhaul capacity to various population centres and with cross-border interconnection points to submarine cables. In 2013-2014, Rwanda developed its WOAN plan under a public-private partnership with Korea Telecom (KT) to deploy 4G LTE. The partnership was granted a 25-year license for the 800 MHz and 1800 MHz bands, which KT makes available under a non-discriminatory wholesale basis to providers of LTE-based services.

The resulting KT Rwanda Networks (KtRN) partnership was formed between Korea Telecom — selected without a public tender and responsible for contributing a USD $140 million investment — and the Rwandan government, which contributes fibre optic assets, spectrum resources and the 25-year license. The partnership’s efforts to foster 4G adoption have varied from cutting down wholesale and package prices to expanding partnerships with various nascent domestic ISPs. The KtRN partnership reached its coverage goal by the end of 2017, providing a 4G coverage rate surpassing 90%, the region’s highest.

The public-private partnership won the Global Telecom Business Magazine’s Global Telecom Business Innovation Award in 2015. In 2018, however, Korean Telecom reported a USD $25.1 million loss, according to figures from the United States Securities and Exchanges Commission. The competitive impact of this network has been unchanged since there are no new MVNOs in the country. However, the partnership has reported various new clients to the regulator, all created after 2014 but together amount to a small fraction of the internet market. Notably, unlimited packages are now available from most of the retail KtRN partners and subscribers with 4G-enabled smartphones.

Despite the government efforts on both the supply and demand sides, Rwanda still faces challenges in its ambitious plans for economic transition. Indeed, by March 2019, only 70,496 of Rwanda’s 5,981,638 internet subscribers were using the 4G network. However, this development comes in the context of a positive trajectory over the past two decades for Rwanda.

Assessing wholesale open access networks

A number of governments have been considering wholesale open access networks as a way to foster competition, decrease costs, and increase connectivity. Different models of these networks are possible, although most rely on public-private partnerships, as the deployment of such networks demands high capital expenditures.

In the case of Mexico and Rwanda, two of the most advanced and promising examples and both based on 4G LTE technology, retail prices have decreased, and new retailers have started to operate. However, there are still doubts regarding the ability of new entrants to offer competitive services. Some criticisms — such as delays in project implementation — are expected, as is common in infrastructure projects. Overall, these projects do offer stakeholders a few lessons: as major infrastructure investments, these projects require extensive political will, capital, and time as foundations for development and impact.

Initial observations from these countries suggest that WOANs can be a viable alternative in certain conditions. These projects are best suited to countries facing lower levels of connectivity and more consolidated markets that require more substantive changes in their broadband market. Regulators looking for more granular innovations to spur competition should look to other policy levers.

5

The role of public access in broadband markets

This year’s Affordability Report focuses on market competition and composition. Public internet access strategies are a crucial tool for complementing a competitive market environment. This chapter underlines how public access forms part of a diverse broadband market, adding competitive pressure, delivering services to people underserved by commercial operators, and providing wider public benefits.

KEY INSIGHTS

- Public access plays a crucial and complementary role for the broadband market: it helps onboard new users for the first time, creates additional points of connectivity, and can stimulate demand for existing services.

- Public access helps expand connectivity at the margins to create a more inclusive digital economy and reduce the digital gender gap.

- In addition to the economic benefits, public access provides social dividends across education, healthcare, and other sectors.

History of public internet access

By the mid-2000s, telecentre and ICT Access Centre programs were introduced in many developing societies to help expand internet access. These facilities took a variety of forms and included offering computers and internet access in established public locations such as post offices, libraries, and schools. The more ambitious programs supported construction and operation of stand-alone multipurpose community telecentres, sometimes offering dozens of PC stations, ICT training, e-government and e-commerce support, and other services.

Most recently, the notion of public internet access has expanded beyond physical facilities, to include free or low-cost public Wi-Fi access, through various government and cooperative platforms. These services are offered in open areas of cities and towns such as parks and community spaces; in government buildings and complexes; in transportation hubs such as bus stations and airports; and even across wider areas using mesh Wi-Fi networks. At the same time, commercial public Wi-Fi offerings have begun to proliferate, with subscription-based or free hotspots increasingly available in coffee shops, restaurants, shopping malls, and many other public spaces.

Snapshot

Farmers deliver mangos to Heny’s home every day in return for a fairer price than wholesale buyers. The farmers, she says, don’t do their own e-marketing because they are unfamiliar with or cannot afford phones. She then uses her access to a public Wi-Fi to find customers for the mangos. Read more »

Economic and market impacts

Public internet access options have played a significant role in the evolution of broadband markets, providing additional choice for customers and impacting the incentives of commercial service providers.

This chapter draws on a wide and rich history of public access programs from across Southeast Asia, including the Pusat internet centre facilities of Malaysia, digital community centres in Thailand, the Tech4ED program in the Philippines, PLIK centres in Indonesia, and cultural post offices in Viet Nam. You can read about each in more detail.

Examples of public access in Southeast Asia

Public access impact on telecommunications markets

Public access services operate within the expansive commercial market for broadband telecommunications services, as a tangential market player with the potential to influence the fortunes and business models of the larger traditional licensed operators (mobile and fixed) in a variety of ways.

Firstly, public access services invariably connect directly with, and pay charges to, private commercial telecom providers. Every retail public access connection, whether through a telecentre, internet café, or Wi-Fi signal, ultimately connects to some combination of wholesale transmission networks and related data hubs and network operating centres that are owned and operated by commercial network providers. Frequently these wholesale providers are also competitive retail operators as well. Thus, most public access services purchase bulk wholesale data connections from commercial providers and in effect “resell” that capacity to their users — usually at very low (or zero) per-unit prices.

For example, a typical small public access facility might obtain a fixed 5–10 Mbps data link from the local internet service provider (which may be affiliated with a national telecom operator or itself be an independent ISP) for the equivalent of USD $50 per month. They might then charge users $0.25 per hour, which is enough to break even or earn a profit with moderate daily demand. An average customer might only spend one hour, but the amount of data they use would have cost upwards of $1.00 in that time, if purchased via a cell phone plan.

This arrangement may at first seem like a bad deal for the commercial market, which appears to “lose” more than 75% of potential revenue from such customers, compared with the retail, per-MB alternative. However, the reality is that the vast majority of public access users’ data consumption represents traffic that would simply not exist if they had to pay for it at the market price. In economic terms, their price elasticity for data usage is extremely high, as they can typically only afford to purchase a limited amount of data each month and will refrain from using the service more once they reach that limit. The result is that public access options let people use much more data at little or no extra cost, without significant revenue loss for retail operators. For the economy as a whole, these benefits represent a net gain which can be very substantial when spread across hundreds of thousands of users.

Commercial operators likely obtain marginally greater revenues from the presence of public access services, due to the purchases of bulk capacity, while reaching marginal customers who would likely not otherwise buy services. Of course, there may be some instances where users do reduce their retail data purchases in favor of public access where it is convenient, but there is little evidence to date to suggest any substantial market shift in this direction.

However, public access has driven changes in market behavior by commercial providers, in part by highlighting and foreshadowing trends in demand that may not be captured in traditional service and pricing practices. This was certainly the case, for example, with Voice over Internet Protocol (VoIP). When Skype and similar services were introduced at internet cafés, demand was enormous, and some telecom operators objected and tried to limit or ban the service, fearing large losses of international voice revenues. Eventually, it became clear that the use of fixed rate data connections to make voice calls could drive demand for data services, and most operators adjusted their pricing plans to encourage data usage growth. Today, WhatsApp, another voice-over-data application, is the most widely used mobile app in the world and is actively allowed and encouraged by mobile operators.

Indeed, many mobile operators have recognised that the shift toward bulk data use, and low cost or free public access, is wholly aligned with their market interest in gaining and retaining customers. They have begun to introduce their own networks of public Wi-Fi hotspots, where subscribers can access data services at no extra charge. Some have also teamed up with content providers such as Facebook to permit so-called “zero-rate” (no cost) use of particular applications. These operators recognise that their long-term interest lies in encouraging the market for high-end mobile and fixed data demand and that many options for public access can support this goal and stimulate long term demand.

Demand stimulation effects

The potential for demand stimulation may represent the most significant economic effect of public internet access. As new or occasional users become more familiar and comfortable with the digital world, they tend to want to visit it more often. Many who may first connect through public access will ultimately shift some of their use toward traditional commercial services for the convenience of personal, non-public access. Hence, public access can help grow the overall commercial market.

This demand stimulation happens in a number of ways. Simple familiarity with the internet typically leads to more use. The rise of social networking is a particularly important factor given its “addictive” qualities and that many users will want to sustain their social connections while away from a public access connection. Another typical pattern is for people to upload personal photos while at a free public access centre, then monitor “likes” and comments via mobile data services later. Users may take advantage of similar data-intensive multimedia social applications while on a public access network, but rely mainly on low-cost text messaging to communicate with friends while out of range.

There has been limited empirical study of these demand stimulation effects of public access, per se — though a World Bank report on public access programs in China provides some validation. However, it is clear that commercial internet and data use has continued to grow in markets where public access programs have been actively promoted, and there is evidence that public access contributes to that ongoing and accelerating growth.

Financial and commercial effects

Public access internet services can also contribute to private financial and commercial benefits for users — which in turn also multiplies the demand stimulation effect, as well as the gains to the local economy as a whole. These types of contributions can take many forms, as users creatively take advantage of the range of opportunities the internet offers. Examples include:

E-commerce and entrepreneurship

Many public internet facilities help local entrepreneurs build online businesses, providing training, assisting with website development, supporting marketing and sales, and offering financial support. Numerous such small e-commerce ventures have been successfully launched through public access programs.

For example, Taiwan has established an extensive network of Digital Opportunity Centres, many of which actively support local merchants and entrepreneurs in establishing online e-commerce businesses. A detailed study of telecentres in Rwanda found that these facilities created a variety of opportunities for local entrepreneurs, including farmers and small businesses, to increase incomes and reduce costs.

Mobile money and e-finance

Public access facilities can often contribute to the growing demand for internet-based financial services, for example by allowing users to access their accounts online, make e-payments, and even to act as agents for mobile money services. Citizens can also make e-payments for private and government services at such locations, for convenience and one-stop shopping.

A number of studies and reports have highlighted this important connection. A report on the role of mobile money in Africa found that most users still require cash for transactions, and many public internet facilities offer both connectivity and cash payouts from mobile money accounts. A report from Kenya showed that internet cafés have become a one-stop shop for government e-payments, increasing their business opportunities.

Remittances

Many users use the internet to receive remittance payments from family overseas, and public access centres can serve as a contact and even cash payout point for such exchanges, similar to their role in supporting mobile money.

In some countries, remittances represent an important slice of the economy, such as in the Philippines where they make up a substantial portion of the country’s GDP. These are frequently processed via public internet connections. Local internet cafés actively advertise the availability of remittance services.

Integration of public access with local business

Another growing trend is for local retail businesses — such as shops, malls, and transport hubs — to provide public internet access to attract customers. These practices can include embedded advertising and promotions for customers accessing the internet via the business portal, generating increased exposure as well as customer loyalty.

Indeed, access to free Wi-Fi is becoming so common in many countries that users are growing accustomed to minimising their data charges and using the internet far more extensively than they could otherwise. In Indonesia, for example, it is reported that there are over 468,000 free public Wi-Fi hotspots.

Social benefits of public access

As well as delivering positive economic impacts, public internet access programs offer a range of important social benefits. These help to underline the importance of delivering internet access for everyone. When people are unable to connect through commercial providers, public access options play a crucial role to fill the gap.

Education

Many public access programs promote a range of educational and training opportunities through digital technologies, particularly for citizens who may have few other options. Such facilities can support students at all levels. For example, the Philippines’ Tech4ED program includes a strong emphasis on providing access to secondary education through internet and computer-based programs designed for out-of-school students. This allows those who cannot attend traditional schools due to work or family obligations to obtain their high school equivalent through an access centre. Other programs allow university students to take distance-learning classes as part of their curriculum.

Snapshot

Free Wi-Fi access on the university campus where Grace works gives her the opportunity to access homework assignments and educational games for her daughter, who joins her at work after primary school. Read more »

Healthcare

The role of advanced ICTs in healthcare is rapidly changing, as new tools and applications are improving access and treatment options. Public access ICT facilities can play an important role in this growing e-health ecosystem.For example, health clinics and hospitals increasingly communicate with their patients via mobile phones and online applications, and many patients may not always have access to data connections or capacity to receive vital information and assistance, often in time-sensitive situations. In some cases, clinics may even provide public Wi-Fi access themselves, to support use by visiting patients as well as staff. At these and other public ICT sites, users can connect to e-health programs and advice, communicate with caregivers, review their medical records, manage appointments, and conduct many other activities.

Digital inclusion

The core mission of many public access programs is to connect those who have been unable to access and use the internet. This often includes people with low incomes or levels of digital literacy and those who live in remote or rural areas. Public access policies can actively support these and other specific groups to get online and access the internet’s benefits. These target groups include:

Women

Public access options can be especially important for women, who may face barriers to accessing devices and data at home. Public access facilities can provide an alternative route to internet access, particularly when established in locations such as marketplaces or near schools, which are convenient for women with care responsibilities to visit. Telecentres can also offer daycare to help mothers take classes or use the internet. Centres can be staffed and managed by women, who can provide outreach and assistance that is welcoming and supportive. Most Pusat internet centres in Malaysia, for example, are operated by women.

Traditional cultures and languages

Public access facilities and services can provide valuable resources for indigenous people who may speak only traditional languages and follow other cultural practices that are not widely addressed by the global or even national internet. User interfaces at ICT centres and on public Wi-Fi services can provide options in such languages, localised by geographic area. Users can be encouraged and assisted to upload culturally diverse content: photos and art, folk tales, ceremonial practices, and even video interviews with community elders, which can be readily available to others, anywhere.

People with disabilities

Public access policies can promote internet access for people in wheelchairs, those with hearing or vision disabilities, and people unable to manipulate standard devices, among others. Commercial providers often do not prioritise serving customers with specialised hardware and software accommodations. Public access facilities can help them access digital technologies and provide technical and financial support for developing specialised access options.

Public access in the market

Public access options within the broadband market offer an essential complement to a healthy and growing digital economy. The benefits are as numerous as they are diverse — from economic dividends to greater digital inclusion, in addition to a range of wider social benefits. These centres, Wi-Fi hotspots, libraries, and other public access options factor into a comprehensive web of connectivity that sustains a wide array of online behaviours and activities. Users are not monolithic: nor should policy strategies for connectivity be.

6

Steps to shape healthy broadband markets

Policymakers must be responsive to market conditions and adopt policies that promote markets that deliver affordable internet access. This year’s research has underlined the importance of healthy broadband markets to drive down prices and expand digital economies. Healthy markets feature three main pillars:

- A robust, competitive, and stable broadband market.

- Affordable backhaul and infrastructure as a foundation for future development.

- Diverse, blended strategies, including public access options, for last mile connectivity in both urban and rural areas.

Promote competition with dynamic regulation

Broadband markets must become more competitive for us to reach universal access. The public and private sectors should work in partnership to build a pro-competition regulatory framework with incentives that encourage investment and innovation.

Governments and regulators can shape these incentives and promote market competition through effective broadband policy:

- Through licensing, regulators can define the number and diversity of internet service providers, especially within the mobile broadband market.

- The process of spectrum allocation, including pricing and clear rules around unlicensed spectrum, affects the number of providers that can afford use of the airwaves they need to provide connectivity.

- By facilitating infrastructure sharing among network operators, regulators can support a higher quality of service and reduce retail prices.

- By establishing stable markets with evidence-based policies and inclusive, consultative processes, regulators can build trust with operators to give them the confidence to make capital expenditures and project returns on their investments.

Supply affordable backhaul and infrastructure

A thriving digital economy cannot succeed without affordable and reliable backhaul and extended infrastructure to sustain it. There are a variety of strategies that can promote affordable backhaul and infrastructure access:

- A number of countries have begun looking at wholesale open access networks. These networks are significant investments — requiring political will, financial capital, and physical time. While not appropriate in all contexts, they may provide a promising solution in some consolidated markets demanding major reform.

- Infrastructure in mobile broadband is not limited to cables and towers: fair and transparent access to spectrum can benefit a country’s telecommunications market. This includes spectrum access for community networks, which play an essential role within a diverse healthy market.

A healthy telecommunications market provides a thriving space to do business. It gives major network operators and service providers regulatory certainty. It provides fair access to affordable backhaul and infrastructure that reduces the barriers to entry, allowing more service providers and a greater variety of providers to enter the market. This infrastructure can also help the digital economy grow, by facilitating more financial transactions and online business activity.

Invest in public access solutions

Public access has been an integral part of ICT strategies for decades, and its value is no less important in 2019 than it was in 1999. While strategies have changed over time, the principles remain the same. Public access is an essential part of broadband planning for achieving universal access, especially where it prioritises investment for communities frequently underserved by the private market.

Public access options provide users more choices for connectivity. They range from public Wi-Fi points to physical facilities — such as libraries, post offices, and community centres — and offer additional opportunities for skill-building and onboarding new users.

As governments develop their broadband plans and consider their market composition, they should:

- Include and invest in public access options as an integral part of a healthy and diverse broadband market.

- Support the role of public access to stimulate market demand for broadband services by prioritising underserved communities.

- Embed inclusive digital skills support within community spaces like libraries and post offices and make sure these facilities are welcoming and safe for all users, regardless of gender, income, or age.

Governments must act to connect the 50% still offline

While the 2019 Affordability Report charts the disappointing lack of policy progress from many governments to address one of the greatest barriers to access, it also underlines the huge power they have to shape healthy markets in a way that brings down costs and gives more people the opportunity to get online.

The world’s governments have committed to delivering universal internet access through the UN Sustainable Development Goals. A failure to meet this target has a direct human cost to all of those who remain offline. The recommendations in this report can help policymakers to renew their efforts to expand connectivity and fulfil the economic and social benefits of widespread, affordable internet access.

7

Annexes

Annex 1: Full 2019 ADI Results

| Country | Access Sub-Index | Infrastructure Sub-Index | ADI Score | ADI Rank (Change) | WB Income Group 2019 |

|---|---|---|---|---|---|

Malaysia Malaysia | 98.17 | 65.62 | 85.33 | 1 (0) | Upper mid |

Colombia Colombia | 85.39 | 74.05 | 83.06 | 2 (0) | Upper mid |

Costa Rica Costa Rica | 88.61 | 63.44 | 79.21 | 3 (1) | Upper mid |

Peru Peru | 81.23 | 68.44 | 77.98 | 4 (-1) | Upper mid |

Mexico Mexico | 78.24 | 68.21 | 76.29 | 5 (0) | Upper mid |

Turkey Turkey | 79.15 | 60.32 | 72.66 | 6 (0) | Upper mid |

Argentina Argentina | 76.1 | 63.09 | 72.51 | 7 (0) | Upper mid |

Thailand Thailand | 79.39 | 55.63 | 70.34 | 8 (1) | Upper mid |

India India | 72.69 | 61.45 | 69.88 | 9 (-1) | Lower mid |

Dominican Republic Dominican Republic | 74.4 | 59.19 | 69.59 | 10 (0) | Upper mid |

Ecuador Ecuador | 73.65 | 59.25 | 69.24 | 11 (0) | Upper mid |

Brazil Brazil | 72.74 | 58.19 | 68.21 | 12 (1) | Upper mid |

Mauritius Mauritius | 76.25 | 50.37 | 65.96 | 13 (-1) | Upper mid |

Pakistan Pakistan | 68.1 | 55.6 | 64.44 | 14 (1) | Lower mid |

Morocco Morocco | 73.67 | 48.75 | 63.78 | 15 (-1) | Lower mid |

Indonesia Indonesia | 74.4 | 46.99 | 63.24 | 16 (0) | Lower mid |

Jamaica Jamaica | 66.99 | 53.42 | 62.73 | 17 (0) | Upper mid |

Jordan Jordan | 61.51 | 57.77 | 62.14 | 18 (3) | Upper mid |

Nigeria Nigeria | 69.22 | 48.11 | 61.13 | 19 (-1) | Lower-middle |

Ghana Ghana | 67.09 | 50.11 | 61.06 | 20 (0) | Lower-middle |

Tunisia Tunisia | 66.63 | 50.05 | 61.02 | 21 (2) | Lower-middle |

Botswana Botswana | 67.64 | 47.67 | 60.08 | 22 (0) | Upper mid |

South Africa South Africa | 69.58 | 45.06 | 59.72 | 23 (-4) | Upper mid |

Viet Nam Viet Nam | 59.63 | 54.19 | 59.3 | 24 (1) | Lower mid |

Sri Lanka Sri Lanka | 64.87 | 46.45 | 57.99 | 25 (-1) | Upper mid |

Philippines Philippines | 64.666<47d> | 46.47 | 57.9 | 26 (5) | Lower mid |

Côte d'Ivoire Côte d'Ivoire | 67.34 | 43.48 | 57.73 | 27 (-1) | Lower mid |

Senegal Senegal | 58.3 | 52.07 | 57.5 | 28 (-1) | Lower mid |

Benin Benin | 57.15 | 50.95 | 56.32 | 29 (0) | Low |

Bolivia Bolivia | 53.6 | 51.1 | 54.55 | 30 (2) | Lower mid |

Rwanda Rwanda | 56.77 | 47.43 | 54.29 | 31 (-3) | Low |

Tanzania Tanzania | 55.11 | 47.73 | 53.58 | 32 (3) | Low |

Egypt Egypt | 56.8 | 44.28 | 52.66 | 33 (0) | Lower mid |

Honduras Honduras | 52.29 | 48.2 | 52.36 | 34 (0) | Lower mid |

China China | 50.27 | 50.02 | 52.25 | 35 (5) | Upper-middle |

Uganda Uganda | 55.24 | 45 | 52.22 | 36 (0) | Low |

Kenya Kenya | 50.26 | 48.76 | 51.59 | 37 (0) | Lower mid |

Cambodia Cambodia | 55.22 | 43.78 | 51.57 | 38 (0) | Lower mid |

Nepal Nepal | 50.31 | 47.37 | 50.89 | 39 (0) | Low |

Mali Mali | 49.68 | 46.77 | 50.26 | 40 (5) | Low |

Bangladesh Bangladesh | 47.41 | 45.29 | 48.3 | 41 (0) | Lower mid |

Namibia Namibia | 43.92 | 46.6 | 47.16 | 42 (2) | Upper-middle |

Myanmar Myanmar | 43.61 | 45.98 | 46.67 | 43 (-13) | Lower mid |

Cameroon Cameroon | 45.47 | 43.19 | 46.19 | 44 (6) | Lower mid |

Mozambique Mozambique | 45.71 | 41.57 | 45.47 | 45 (-2) | Low |

Zambia Zambia | 45.93 | 40.34 | 44.94 | 46 (0) | Lower mid |

Venezuela Venezuela | 41.01 | 44.26 | 44.42 | 47 (-5) | Upper mid |

Kazakhstan Kazakhstan | 54.48 | 30.54 | 44.48 | 48 (3) | Upper mid |

Burkina Faso Burkina Faso | 44.61 | 37.5 | 42.77 | 49 (0) | Low |

Gambia Gambia | 46.5 | 33.53 | 41.69 | 50 (-2) | Low |

Guatemala Guatemala | 41.48 | 37.08 | 40.93 | 51 (-4) | Upper mid |

Malawi Malawi | 40.76 | 28.74 | 36.2 | 52 (2) | Low |

Zimbabwe Zimbabwe | 44.99 | 23.97 | 35.92 | 53 (-1) | Lower mid |

Sudan Sudan | 42.94 | 25.62 | 35.72 | 54 (-1) | Lower mid |

Nicaragua Nicaragua | 36.74 | 29.79 | 34.66 | 55 (0) | Lower mid |

Liberia Liberia | 27.83 | 18.17 | 23.96 | 56 (0) | Low |

Sierra Leone Sierra Leone | 29.08 | 15.89 | 23.43 | 57 (0) | Low |

Congo, DR Congo, DR | 21.44 | 14.59 | 18.77 | 58 (0) | Low |

Haiti Haiti | 14.17 | 18.31 | 16.92 | 59 (0) | Low |

Ethiopia Ethiopia | 14.73 | 18.31 | 16.92 | 60 (0) | Low |

Yemen Yemen | 0.00 | 0.00 | 0.00 | 61 (0) | Low |

Annex 2: Methodology: Affordability Drivers Index

The Affordability Drivers Index (ADI) is a composite measure that summarises in a single (average) number an assessment of the drivers of internet affordability in various countries. Benefiting from the research framework established by the Web Index, the ADI covers 61 countries and focuses on two key aspects driving affordability: communications infrastructure and access.

Two types of data are used in the construction of the Index: data from other providers (‘secondary data’) and data gathered via a multi-country expert researcher survey (‘primary data’).

The primary data consist of an expert survey. The survey includes questions — scored on a scale of 0–10 — on issues regarding policy, regulation, and other aspects around broadband and affordable access to the internet. The questions were specifically designed by A4AI, the Web Foundation, and its advisers. These primary data, based on and aligned with the A4AI Policy and Regulatory Good Practices, attempt to assess the extent to which countries have achieved a policy and regulatory environment that reflects the best practice outcomes. Survey questions were scored based on predetermined criteria by country experts. On average, two experts per country were asked to provide evidence and justification to support each score. The scores were checked and verified by a number of peer and regional reviewers.Last year, we conducted a new round of policy surveys on the 61 countries covered by the ADI between June and August 2018 by regional policy experts and included a peer-review process to improve the accuracy of the results.

In addition, we draw on a range of secondary indicators to derive the sub-indices described above as well as the final composite index. All secondary indicators have been updated with the latest available data as of September 2019.

Data sources and data providers

We employ data from several large international databases to measure or proxy the dimensions under study. Before an indicator is included in the Index, it needs to fulfil four basic criteria:

- Data providers have to be credible and reliable organisations, which are likely to continue to produce these data (i.e., it is not a one-off dataset publication).

- Data releases should be regular, with new data released at least every three years.

There should be at least two data years for each indicator, so that a basic statistical inference could be made. - The latest data year should be no older than three years back from publication year.

- The data source should cover at least two-thirds of the sample of countries, so that possible bias — introduced by having a large number of indicators from one source that systematically does not cover one-third or more of the countries — is reduced.

All the indicators included in the ADI are listed below, where they are grouped by sub-index and type (primary sources or secondary sources). There are two distinct types of indicators: primary and secondary. The primary indicators (codes A1–A14) are collected via the policy surveys described earlier. The secondary sources include data collected by the ITU, GSMA Intelligence, and the World Bank.

The indicators used in the ADI represent a comprehensive set of factors that influence broadband affordability. However, this is not a complete list as there may be other important factors which cannot be included because they do not meet the criteria above. In such cases, we conduct supplementary analyses to the index as we have done in the past by looking at income and gender equality.

The factors that the ADI covers are grouped into two sub-indices — infrastructure and access:

- The infrastructure sub-index measures the current extent of infrastructure deployment and operations, alongside the policy and regulatory frameworks in place to incentivise and enable cost-effective investment in future infrastructure expansion. Variables included in this sub-index include, for example, the amount of international bandwidth available in a particular country, and an assessment of a nation’s spectrum policy.

- The access sub-index measures current broadband adoption rates and the policy and regulatory frameworks in place to encourage growth and ensure provision of affordable and equitable access.This sub-index includes variables such as current internet penetration rates and an assessment of the effectiveness of a country’s Universal Service and Access Funds.

| Type (Code) | Access Sub-index Indicators |

|---|---|

| Primary (A5) | Clear, time-bound targets in National Broadband Plan for reducing cost & increasing penetration |

| Primary (A12) | USAFs used to subsidise access for underserved and underprivileged populations |