View the 2018 Affordability Report as a PDF

2018 Affordability Report

i

Executive Summary

This year marks the fifth annual edition of the A4AI Affordability Report. In these five years, we’ve seen issues around internet access and affordability step into the spotlight, and have seen a growing number of countries acknowledge the need to put digital strategies at the heart of their plans for development and economic growth.

Despite this progress, the past five years have also seen a serious slowdown in the rate at which people are coming online. Based on trends using ITU internet use data, last year’s Affordability Report predicted that we would achieve 50% global internet penetration by the end of 2017; a downturn in the growth of internet access and use means that we now don’t expect to reach that milestone until mid-2019.

Inability to afford a basic internet connection remains one of the most significant — and solvable — barriers to access. Around the world, over two billion people live in a country where just 1GB of mobile data is unaffordable. This issue is particularly acute in low- and middle-income countries, where 1GB of data costs over 5% of what people earn in a month — a price that is well over the affordable threshold of 1GB of data priced at 2% or less of average income.

The 2018 Affordability Report examines how the policies to accelerate access to affordable internet have progressed these past five years across 61 low- and middle-income countries, and where they stand today. Our research finds that while policies continue to improve on the whole, the pace of policy change remains far too sluggish and incremental to effect the change needed to enable affordable access for the billions still offline:

- Policy progress is slowing. Despite increasing recognition of the critical relationship between online access and economic growth, the pace of policy change to drive internet prices down marked its slowest improvement to date, with policy scores increasing by just 1% since last year.

- For the first time ever, global average policy scores went down. While policies on the whole improved marginally, we saw scores backslide across measures of (1) the regulatory environment and (2) policies around universal and public access. The latter is particularly concerning given that our research shows public access policies to be strongly correlated with reduced broadband prices.

- Infrastructure is faltering. Over the past few years, progress on the drivers of affordability has been pushed primarily by improvements in access policies. Policies to expand and further develop infrastructure have stagnated — a point that is reinforced by costs that remain stubbornly high for internet providers and consumers alike.

- Island archipelago nations face particular challenges in providing affordable internet. New analysis on the industry costs incurred in the provision of internet service shows that the cost to provide one subscriber with mobile broadband data for a year in an island archipelago nation like the Philippines is nearly five times the cost to do the same in a coastal nation like Nigeria.

To stand a chance at closing the digital divide and enabling affordable access opportunities for the billions around the globe still offline, we need governments — supported by private sector players and civil society — to prioritise the time and resources needed to build the policies, practices and infrastructure to drive down internet costs. This report lays out specific recommendations for filling policy gaps and accelerating needed progress, including to:

- Develop cost reduction strategies that are rooted in an understanding of a country’s unique geographic challenges.

Updating or building new infrastructure is an important step in enabling more affordable connectivity opportunities for the unconnected. New infrastructure policy and financing must be rooted in an understanding of a country’s unique geographic challenges, and how they impact the various industry cost components. Governments, development institutions, multilaterals and others can work, for example, to support regional initiatives to lower international transit costs and interconnection rates for landlocked countries, to offer interest-free loans to small island nations to access submarine cables, or to encourage sub-regional partnerships to access submarine cables and other needed infrastructure.

- Develop or update national broadband plans that contain concrete and realistic targets and timelines.

Research shows that countries with a broadband policy that clearly outlines goals and strategies for increasing internet penetration tend to have higher rates of broadband adoption. The most effective broadband policies provide the public and private sectors with clear guidance and a roadmap to sector development, and will support regulatory certainty by laying out plans and time-bound targets to support network development, expand internet access and address market gaps that might otherwise be neglected.

- Establish and implement effective Universal Service & Access Funds.

Universal Service & Access Funds (USAFs) are intended to expand opportunities for connectivity to all, and offer an untapped opportunity for working to connect those at the margins of society, or those that might not otherwise be able to afford to connect. Funds can be used, for example, to finance infrastructure development in underserved areas and among marginalised population groups, or to widen opportunities for individual access through end-user data and device subsidies. More specifically, USAFs can be used to reduce the digital gender gap within countries as a step towards ensuring universal access.

- Commit to effective spectrum allocation processes.

Emphasis should be on transparent, accountable, timely, and efficient allocation of spectrum for existing internet service providers (ISPs) who serve various market segments, as well as to non-traditional ISPs, such as community networks.

As our lives move ever more into the digital space, access to the internet becomes an increasingly basic need, and a critical prerequisite for effective participation in society. There has often been an assumption that market forces will, on their own, lead to everyone, everywhere being able to afford to come online, but, as we have seen over the past five years, affordable access is not a given outcome. Connecting the last billions, including those living in hard-to-reach places, will require targeted policy interventions aimed at tackling their unique barriers to access.

The chronic failure to prioritise broadband policy has led to slowing growth, missed internet penetration targets, and a growing gulf between the world’s online and offline populations. The longer we wait, the more urgent it becomes to take action to close this digital divide, and enable access opportunities for the billions that continue to be shut out from the digital revolution. Policymakers must take an active role in charting the course toward a strong policy and regulatory environment, setting broadband strategy, investing in universal and public access, facilitating infrastructure sharing, and managing spectrum. We hope our next report will document a shift toward positive action, change, and affordable access for all.

1

2018: Where are we on the road to affordable, universal internet access?

The 2018 Affordability Report marks the fifth edition of this annual report. In the five years since our inaugural Affordability Report, a growing body of evidence connecting increased internet penetration and economic growth has emerged. At the same time, we’ve seen a global consensus develop around the critical importance of internet access for socio-economic development — a point cemented in the Sustainable Development Goals, which call for affordable, universal internet access by the year 2020.

However, this progress belies a challenging reality. While we expect to cross the significant milestone of 50% global internet penetration in mid-2019, we are seeing a slowdown in the growth of internet access and use. Today, more than half the world’s population is offline. This offline population — mostly people living in low- and middle-income countries and mostly female — remain excluded from the benefits of internet access and face increasing marginalisation, particularly as connected populations move their lives increasingly into the digital realm. This digital divide undermines opportunities for wider socio-economic development and threatens to entrench existing patterns of inequality.

Affordability remains one of the most significant obstacles to internet access around the world, with 2.3 billion people living in a country where a 1GB mobile broadband plan is unaffordable for individuals earning an average income. A number of national household surveys over the last few years have cited the high cost to connect as one of the major factors keeping people offline — unsurprising when you consider that across low- and middle-income countries, just 1GB of mobile broadband data costs 5.5% of average monthly income. Only 24 of the 61 countries assessed in this year’s report have “affordable” internet (i.e., meet the “1 for 2” affordability target) — and even in those countries, high income inequality means that prices remain unaffordable for those earning the least.

Figure 1. Affordability of 1GB mobile prepaid broadband plan, by region (2015-2017)

The cost of an internet connection is determined by a variety of factors, from the level of competition in the ICT market to the geographic attributes of a country or region. Overcoming the affordability challenge requires policy that works to tackle these factors. After five years of Affordability Report research, we have documented the power of good policy to reduce connectivity costs and enable more opportunities for affordable access, and we know the policies that can drive the most impact.

Despite this evidence, this year’s research shows, once again, that many governments around the globe continue to delay action on developing the broadband policy needed to effect these changes. The stakes of failing to prioritise this policy are too high to ignore, and the consequences of this delayed action are starting to be seen — uptake of internet is slowing, digital divides are growing, and prices are not coming down to the levels needed to open up access opportunities for those offline. With each passing year of inaction, the need for action to tackle these issues, close the digital divide, and work toward universal access becomes ever more urgent.

In this report, we examine the current state of policy to advance affordability across 61 low- and middle-income countries, where and how this policy has evolved over the past few years of research, and look specifically at where stakeholders — in government and across the private and civil society sectors — can focus their efforts to drive more affordable internet access and use. We also examine the impact of geography and population on the cost to connect, and consider how governments and other stakeholders can work to tailor their policy frameworks to overcome the unique challenges and opportunities that their geography presents.

2

How have policies to improve affordability progressed?

A country’s policy context is one of the most significant factors in determining the cost to connect to the internet. Policy change has a measurable impact, even in the most economically and geographically disadvantaged contexts. This is why we developed the Affordability Drivers Index (ADI) and update its rankings annually with this report.

The ADI is a tool developed by the Alliance for Affordable Internet (A4AI) to assess how well a country’s policy, regulatory, and overall supply-side environment is positioned to lower industry costs and ultimately create more affordable broadband.

The ADI does not measure actual broadband prices, nor does it tell us how affordable broadband is in a given country. Instead, it scores countries across two main policy groups:

- Infrastructure — the extent to which ICT infrastructure has been deployed, as well as the policy framework in place to encourage future infrastructure expansion; and

- Access — current broadband adoption rates, as well as the policy framework in place to enable equitable access.

High ADI scores correlate with reduced broadband costs on both the industry side and for consumers. As Figure 2 shows, there is a negative and statistically significant correlation between a country’s ADI score and the affordability of a 1GB mobile prepaid broadband plan — reaffirming that improving policies and regulations to lower industry costs should be a priority for all, and particularly for low- and middle-income countries.

Figure 2. Comparison of ADI scores & affordability of 1GB mobile prepaid plans (2017)

| Country | Access Sub-index Score | Infrastructure Sub-index Score | ADI Composite Score | Rank 2018 |

|---|---|---|---|---|

Malaysia Malaysia | 95.59 | 60.08 | 82.44 | 1 |

Colombia Colombia | 83.38 | 66.02 | 79.12 | 2 |

Peru Peru | 80.71 | 63.2 | 76.21 | 3 |

Costa Rica Costa Rica | 86.2 | 57.14 | 75.91 | 4 |

Mexico Mexico | 76.05 | 63.3 | 73.8 | 5 |

Turkey Turkey | 75.26 | 55.67 | 69.33 | 6 |

Argentina Argentina | 71.99 | 58.2 | 68.94 | 7 |

India India | 71.49 | 56.59 | 67.83 | 8 |

Thailand Thailand | 77.5 | 50.36 | 67.71 | 9 |

Dominican Republic Dominican Republic | 71.35 | 54.1 | 66.44 | 10 |

Ecuador Ecuador | 71.45 | 53.18 | 66 | 11 |

Mauritius Mauritius | 76.66 | 45.75 | 64.83 | 12 |

Brazil Brazil | 68.13 | 53.58 | 64.46 | 13 |

Morocco Morocco | 69.84 | 48.72 | 62.79 | 14 |

Pakistan Pakistan | 65.74 | 52.39 | 62.56 | 15 |

Indonesia Indonesia | 73.42 | 43.88 | 62.12 | 16 |

Jamaica Jamaica | 65.41 | 48.32 | 60.23 | 17 |

Nigeria Nigeria | 65.13 | 44.72 | 58.17 | 18 |

South Africa South Africa | 66.81 | 43 | 58.16 | 19 |

Ghana Ghana | 62.64 | 47.03 | 58.08 | 20 |

Jordan Jordan | 61.76 | 47.26 | 57.73 | 21 |

Botswana Botswana | 64.62 | 43.84 | 57.44 | 22 |

Tunisia Tunisia | 60.02 | 47.05 | 56.8 | 23 |

Sri Lanka Sri Lanka | 62.3 | 43.2 | 55.87 | 24 |

Viet Nam Viet Nam | 58.65 | 46.03 | 55.44 | 25 |

Côte d'Ivoire Côte d'Ivoire | 64.48 | 39.79 | 55.22 | 26 |

Senegal Senegal | 55.67 | 47.64 | 54.71 | 27 |

Rwanda Rwanda | 58.61 | 43.85 | 54.26 | 28 |

Benin Benin | 54.13 | 46.92 | 53.51 | 29 |

Myanmar Myanmar | 48.45 | 52.48 | 53.46 | 30 |

Philippines Philippines | 55.15 | 43.04 | 52 | 31 |

Bolivia Bolivia | 52.65 | 43.88 | 51.12 | 32 |

Egypt Egypt | 55.13 | 40.89 | 50.85 | 33 |

Honduras Honduras | 51.3 | 43.7 | 50.31 | 34 |

Tanzania Tanzania | 52.68 | 42.13 | 50.21 | 35 |

Uganda Uganda | 54.83 | 39.61 | 50.01 | 36 |

Kenya Kenya | 48.92 | 45.48 | 50 | 37 |

Cambodia Cambodia | 52.75 | 39.7 | 48.96 | 38 |

Nepal Nepal | 47.05 | 43.43 | 47.92 | 39 |

China China | 47.18 | 42.16 | 47.31 | 40 |

Bangladesh Bangladesh | 46.82 | 41.84 | 46.95 | 41 |

Venezuela Venezuela | 50.74 | 36.63 | 46.27 | 42 |

Mozambique Mozambique | 46.5 | 38.89 | 45.22 | 43 |

Namibia Namibia | 38.73 | 43.49 | 43.54 | 44 |

Mali Mali | 39.21 | 40.41 | 42.17 | 45 |

Zambia Zambia | 44.9 | 33.88 | 41.72 | 46 |

Guatemala Guatemala | 43.21 | 33.68 | 40.72 | 47 |

Gambia Gambia | 44.61 | 31.98 | 40.56 | 48 |

Burkina Faso Burkina Faso | 40.1 | 35.46 | 40.01 | 49 |

Cameroon Cameroon | 35.03 | 39.11 | 39.27 | 50 |

Kazakhstan Kazakhstan | 49.84 | 22.17 | 38.14 | 51 |

Zimbabwe Zimbabwe | 44.05 | 21.86 | 34.91 | 52 |

Sudan Sudan | 41.51 | 24.18 | 34.79 | 53 |

Malawi Malawi | 36.78 | 27.71 | 34.15 | 54 |

Nicaragua Nicaragua | 35.07 | 26.86 | 32.8 | 55 |

Liberia Liberia | 22.07 | 17.69 | 21.06 | 56 |

Sierra Leone Sierra Leone | 19.38 | 11.13 | 16.16 | 57 |

Congo, DR Congo, DR | 16.17 | 9.76 | 13.73 | 58 |

Haiti Haiti | 9.11 | 15.59 | 13.08 | 59 |

Ethiopia Ethiopia | 10.64 | 3.68 | 7.58 | 60 |

Yemen Yemen | 0.00 | 0.00 | 0.00 | 61 |

Note that the 2018 ADI uses a revised methodology (see Annex) and is not directly comparable with those of previous years. Scores are out of 100.

2.1Access policies are driving progress for top-ranked countries

The top-ranked countries on the 2018 ADI all perform well across the access sub-index, which measures investments in public access, effective use of USAFs, smartphone adoption, and level of market competition among mobile operators. The positive performance on access policy is particularly notable when compared to performance on the infrastructure sub-index, which considers policies to simplify licencing frameworks, ensure transparent and timely spectrum allocation, enable number portability, and increase the number of internet exchange points. In fact, among the 10 ADI top-ranked countries, the average increase in the access sub-index score over the last three years was two times the increase seen across the infrastructure sub-index scores.

This year, Malaysia, Colombia, Peru, Mexico, and Costa Rica lead the ADI pack. (See Figure 3 for the full results.) All these countries have demonstrated regulatory certainty, market maturity, and good practices within the telecommunications sector that help enable affordable broadband prices.

Malaysia this year takes the number one spot in the ADI rankings. The country’s stable use of established sector practices bolstered regulatory confidence, and new policies helped to spur further growth. The regulator continues its positive practice of making information publicly and regularly available online to enable public consultation and input in its decision-making. Policymakers continue to revisit, reissue, and reset targets with a high degree of accountability. Since the last Affordability Report, the country issued its 2017 Spectrum Plan and set out plans for transparent management of its spectrum resource.

For the third year running, countries in Latin America & the Caribbean dominate the ADI top 10. Colombia leads the way in the region, thanks to a market that continues to perform well and a move toward informed and evidence-based regulatory decision-making by the country’s regulator. The country has taken action to curb anti-competitive behaviours in the market and, in 2017, further clarified infrastructure sharing rules and added new, non-enforcement-based strategies to encourage market innovation and efficiency.

Peru’s regulator continues to instill confidence through its use of an informed, evidence-based, and transparent decision-making process. The country has also taken a number of steps to improve the quality of internet service, through both transparent reporting on service quality and use of non-enforcement powers to encourage cooperation and innovation in areas of low coverage.

Consistent practices in telecommunications licensing and transparent broadband planning in Costa Rica contributed to the country’s high ADI score. The country continues its positive practice around public consultation in regulatory decision-making and clear, transparent, and regular monitoring of progress along the timeline set out in its National Plan for Telecommunications.

Mexico’s wholesale national mobile network Red Compartida — which aims to increase market competition and to drive access opportunities for those in rural and underserved communities — readied for launch, and the country has continued to issue spectrum via a clear, transparent and competitive process.

2.2Lower-middle income countries are seeing the most change

Measuring performance on the ADI over time gives us good insight on the evolution of policy and regulation that can advance affordable access. Over the last three years, some countries have performed well, moving up several places each year. However, most countries overall have not shown significant progress over this period — while 24 countries have moved up in rank since 2015, 30 moved down, and seven remained in the same position. Most movement in the rankings has occurred among lower-middle income countries: all countries that have remained in the same ADI position are either in the top ten (all of which are also upper-middle income countries) or in bottom ten (all of which are low-income countries).

India and Brazil are two of the biggest movers on this year’s ADI. India moved up nine places to its current eighth place ranking because of several positive changes, including effective use of its Universal Service & Access Fund (USAF) and increased investments in public access solutions. India’s regulator, TRAI, continues to support a competitive mobile market, resulting in India scoring highest of all 61 countries for market competition in mobile telephony. India also had the second highest increase in private sector investments in the market (i.e., investments per subscriber).

Alternatively, Brazil this year moved down seven places in the ADI to its current 13th-place ranking. This drop results from a number of factors, including slowing growth in smartphone adoption rates, and continued delays to implement new rules to improve public rights of way facilitation and tower zoning permissions.

| Country | Rank 2018 | Rank 2017 | Rank 2016/15 |

|---|---|---|---|

Malaysia Malaysia | 1 | 2 | 1 |

Colombia Colombia | 2 | 1 | 4 |

Peru Peru | 3 | 4 | 6 |

Costa Rica Costa Rica | 4 | 5 | 3 |

Mexico Mexico | 5 | 3 | 12 |

Turkey Turkey | 6 | 7 | 5 |

Argentina Argentina | 7 | 8 | 7 |

India India | 8 | 17 | 23 |

Thailand Thailand | 9 | 14 | 9 |

Dominican Republic Dominican Republic | 10 | 13 | 17 |

Ecuador Ecuador | 11 | 9 | 10 |

Mauritius Mauritius | 12 | 10 | 11 |

Brazil Brazil | 13 | 6 | 2 |

Morocco Morocco | 14 | 12 | 8 |

Pakistan Pakistan | 15 | 18 | 21 |

3

Which policy areas have progressed the most — and which are in need of urgent action?

Despite good progress across a few countries, the overall story is one of slow progress. Slow improvements in broadband affordability among low- and middle-income countries reflect limited progress across the five policy areas that have the power to drive improved affordability: (1) regulatory environment; (2) broadband strategy; (3) universal and public access; (4) infrastructure sharing; and (5) spectrum management.

| Thematic clusters | |

|---|---|

| Cluster 1 Regulatory Environment | Licensing, regulator transparency and competency, market competition, evidence-based decisions |

| Cluster 2 Broadband Strategy | National broadband policy, guidelines for public investment |

| Cluster 3 Universal & Public Access | Universal Service Fund strategies, end-user subsidies, public access investments |

| Cluster 4 Infrastructure Sharing | Rights of way and tower zoning, public facilitation of infrastructure sharing |

| Cluster 5 Spectrum Management | Time-bound forward planning, allocation transparency, unlicensed permissions |

Each indicator within the cluster is scored from 0 to 10, with 10 representing the ideal good practice. The cluster scores are the average of all indicator scores in that cluster. See Annex for further details.

Policies have improved across three of the five policy clusters assessed in our research: (1) broadband strategy; (2) infrastructure sharing; and (3) spectrum management. However, improvement across all policy clusters remains too slow and incremental to drive down prices at the rate necessary to ensure universal and affordable internet access in line with internationally agreed targets.

Figure 6. Global average score by policy cluster, 2015-2018

3.1Regulatory Environment

The regulatory environment plays a defining role in supporting the telecommunications sector. An effective regulator will oversee a simple and efficient licensing framework, operate transparently, hold a reputation for subject competency and fair enforcement, and objectively make its decisions based on evidence rather than political influence.

Overall, regulatory performance around the world has not changed much since our last review. None of the four indicators in this cluster changed more than 1.5% from their global average in the 2017 Affordability Report, making them the most static cluster over the past year. However, some changes are worth noting.

A number of countries in Africa have seen substantial changes since the last report. Benin, for example, adopted a new, broad-based Code du Numérique (Digital Code) in 2017, and the regulator, ARCEP, became markedly more confident and regular using its enforcement powers. In the same year, the Zambian regulator switched to a convergent licensing framework — a move away from service-specific licensing that will simplify the licensing process for operators and better facilitates technological innovation and mobile broadband network improvements. Uganda also has taken positive steps to build political consensus toward policy change with new draft policies on infrastructure sharing and spectrum management.

Slow as policy progress has been over the past few years, we have this year seen a further deceleration in this already-slow rate of growth. Between 2016 and 2017, the average increase in policy scores across all clusters was approximately 10%; between 2017 and 2018, this average increase was down to just 1.1%.

This year’s report also marks the first time global average policy scores have gone down. At the global average, scores on both the (1) regulatory environment and (2) universal & public access policy clusters dipped from their 2017 peak (by -0.02, -0.15 points respectively). This downward turn illustrates the need for consistent policy action to keep pace with technological innovation.

Below, we take an in-depth look at the progress made over these five key policy clusters to gain insights into where countries are slipping, and where they can focus attention and resources to accelerate progress toward enabling affordable internet access for all.

OTT service taxes in Africa risk eroding affordability progress

Alarmingly, many of the countries in sub-Saharan Africa that have made progress in some policy areas (e.g., Benin, Zambia, Tanzania, and Uganda) have also recently started to tax the use of popular over-the-top (OTT) services like voice over internet protocol (VoIP), instant messaging, and social media websites. The purpose of these sector-specific taxes has been repeatedly questioned and criticised for their negative impact on freedom of expression and internet affordability. Research from A4AI demonstrated that the social media tax in Uganda would increase the cost of already expensive mobile data services in the country to 10% of average monthly income, and would have a disproportionate impact on low-income users. A new social media tax in Benin caused the cost of 1GB of mobile data to skyrocket 250%, before public pressure convinced the government to annul the tax. Sector-specific taxes like these perpetuate the myth that internet access and social media use are luxuries and disproportionately limit low-income users’ experience with the web.

Elsewhere, regulatory environments are making positive steps and offer exemplars for good practice. One example of positive initial steps is the announced partial divestment of the state-owned operator in Ethiopia and its split into two companies to spur market competition. The monopoly status of Ethio Telecom has restrained Ethiopia’s performance on the ADI over the past three years — the worst for any country in Africa.

Particular progress has also been made on improving regulation around the quality of service (QoS) of mobile broadband, with Peru working toward transparent benchmarking of QoS and the growth of open, consultative practices in Colombia. In addition, the policy survey this year found especially promising ongoing practices by the Indian regulator, TRAI, which serves as a trusted point of information exchange on the quality of service, hosting an online analytics portal and an easy-to-use directory of reports and releases detailing the results of quality of service measurements. In tandem, TRAI has been able to confidently implement stricter rules for operators and penalties for non-compliance. These factors, along with regulatory support for competition in the market, helps explains India’s improved performance on the ADI this year.

3.2Broadband Strategy

Effective broadband policies provide public and private sectors clear guidance and a roadmap to sector development, allowing stakeholders to better plan and anticipate market and infrastructure conditions into the near future. This supports an enabling culture for private investment and innovation where operators can function with legal and regulatory certainty. Effective broadband strategies also set clear, transparent plans and targets to support network development and expand internet access over a wider geography and to a larger number of people, addressing market gaps that otherwise would likely be neglected.

High-level broadband policymaking and strategy-setting is the most dynamic field of this year’s policy survey. Indeed, the two indicators within this cluster represent two of the three biggest changes in comparison to scores from the 2017 report. Much of this new leadership has been in Asia-Pacific region.

At least seven countries have released a national broadband plan or major consultative draft with updated access targets since the last Affordability Report. Plans have been developed in each continent (e.g., Bolivia, Tunisia, the Philippines) and at different levels of average income (e.g., Senegal and Turkey), but with a confluence of action in Asia (e.g., India and Nepal). The widespread nature of this positive trend supports a growing consensus that all countries have potential social and economic gains with targeted and strategic investment in broadband internet access.

Bolivia’s National Broadband Plan: Clear objectives and time-bound targets but implementation will be key to secure progress

Bolivia approved a new National Broadband Plan in early 2017. Covering the period until 2020, the plan provides clear objectives, time-bound targets, and timelines associated with a set of activities to support broadband implementation. With an overall objective to promote the expansion of telecom infrastructure for the provision of broadband based internet access, the plan aims to:

- Increase broadband connections in the country;

- Support the development of the national backbone infrastructure; and

- Promote and support the expansion of broadband infrastructure to support access to online education, health, economic, and information services.

It further establishes specific targets to be achieved by 2020:

- 50% of households connected to broadband services;

- 90% of education institutions with broadband access;

- 100% of localities (as defined by size of population) connected to the national backbone; and

- 100% of health care facilities in localities and municipal capitals with broadband access.

With clear guiding principles on universal access to all women and men, net neutrality, and infrastructure data, Bolivia’s national broadband plan promotes investment and expansion, while also encouraging increased sharing of resources. It establishes an infrastructure mapping system to increase transparency around infrastructure locations, and a mechanism to measure progress on a quarterly basis. It also creates a coordination and institutional framework to implement the plan’s activities according to its timeline.

The key element to secure success will be the implementation of the plan. With an ADI ranking of 32 — one of the lowest in South America — the plan sets the stage for significant improvements in the country.

By comparison, other countries’ progress is hampered by continued reliance on outdated ICT policies or vague strategies. Indicators for Zambia and Haiti dipped as the telecommunications sector in both countries continues to strain against ICT policies that date back to 2009 and to 1977, respectively. Given the fast pace of technological advances within mobile broadband, historic legislation can impose a technologically limited regulatory environment on operators that stifles investment and innovation.

However, even some updated policies miss the mark and fail to take advantage of the opportunities presented by a policy review. The updated 2017-2021 Strategic Plan for South Africa’s USAF, for example, avoids setting clear and accountable targets in line with the country’s long-term ICT strategy, South Africa Connect. This is a missed opportunity and partly explains why the country’s ADI ranking (currently 19) has not improved since 2017.

In Western Africa, two countries in particular have taken key steps toward defining and implementing effective and measured strategies, in partnership with the private sector, helping to improve their ADI scores and rankings since the last report. Burkina Faso, which saw its ADI ranking rise five places since last year, has made strides toward achieving its Programme national de développement économique et social (National Social & Economic Development Plan), thanks to a series of public-private partnerships to build the country’s national backbone network and international backhaul. In addition, the new National Broadband Plan in Senegal — whose ranking went up 17 places — includes extensive targets on expanding broadband access across the country as part of public investment strategy.

3.3Universal & Public Access

While no single strategy can promise universal access to the internet, policies must focus on developing and implementing strategies that aim specifically to enable access for those least likely to be connected. Investments in public access initiatives and the development and effective use of USAFs to finance and grow these efforts can help to drive connectivity to the widest margins of society, and curb the potential for technology to exacerbate pre-existing inequalities in society.

The decreasing performance of universal access policies seen in this year’s survey is particularly alarming, given the fact that no single indicator or cluster holds a stronger correlation with the current affordability of mobile broadband for consumers than countries’ investment in public access points. Comparing ADI data with mobile broadband pricing over the past two years suggests that investment in public access has an outsized impact on driving down prices — a trend that re-emphasises the essential role that USAFs and public access must play in an effective and comprehensive broadband strategy.

Figure 7. Mobile data affordability vs. public access investment, 2017-2018

A number of countries around the world do not yet have USAFs in place. Even where they exist, research shows that the funds are often sitting dormant or are being co-opted for other uses. In The Gambia — where 1GB of mobile broadband data costs nearly three times what it does for a user in neighbouring Senegal — no USAF has been set up, nor any contributions collected from operators, despite the fact that The Gambia’s Information and Communications Act 2009 calls for such a fund to be established. In Kenya, the president requested Kshs 1 billion from the country’s USAF to spend on fighting cybercrime, rather than extending internet access. In other countries, like Brazil, the USAF was originally set up to improve access to voice services and continues to do just this; a separate government program exists to invest in broadband access and does not operate as a USAF.

USAFs lead the way to affordability in Asia-Pacific

In countries where USAFs are given the regulatory independence and budgetary resources needed to function effectively, we have seen a number of positive impacts — particularly in the Asia-Pacific region.

- In Thailand, the regulator lifted its previous suspension of support for the country’s USAF in October 2016. This move has allowed major projects to move ahead, including the planned fiber optic network that aims specifically to expand coverage in rural and remote areas of the country.

- In Pakistan, USAF money is being put to use to achieve an expansive strategy to cover underserved areas and programs to close the digital gender gap. The regulator has also made current financial statements and annual reports readily available online to the public.

Indonesia has used its USAF to address a number of next-generation internet issues, supporting the creation of the content and apps needed to create a more relevant and engaging ICT ecosystem for the country’s rural communities.

The value of USAFs and their work to expand access opportunities to those least likely to be connected lies, in large part, in their political independence. This political independence protects the sustainability of public access investments by governments and preserves the social and economic benefits that can be achieved through greater affordability.

Other strategies towards public access outside of USAFs have received note as well. In the Philippines, the Tech4ED program has worked to establish over 2,000 public access points across the archipelago nation, with priority for regions with lower rates of connectivity and internet use.

3.4Infrastructure Sharing

High capital costs can create barriers for both new market entrants and current operators trying to expand their network coverage. Facilitated infrastructure sharing creates opportunities to eliminate network redundancies, support greater market competition, and reduce overhead costs by as much as 45%.

Across regions and income groups, countries have made consistent, moderate steps in the right direction over the past two years. At the global average, at the regional level, and when disaggregated by income group, the two indicators within this cluster rose by moderate amounts, all in a positive direction. While progress on this issue has slowed compared to the leaps made between the 2016 and 2017 reports, the consistency of a positive direction in all parts of the world suggests a strong political consensus on this issue.

Countries at various stages of policymaking on this issue made progressive, positive steps toward greater market efficiency — all of which have helped to improve their ADI scores and rankings. For example, key victories were seen in the Dominican Republic and Tanzania (both of which improved by three spots in the ADI rankings), as regulators in each country issued new guidelines on infrastructure sharing. India was one of the first countries to adopt policies on passive infrastructure sharing and in 2016, adopted a framework for voluntary active infrastructure sharing between operators; the country now has one of the most competitive mobile markets in the world. Indonesia was one of the earliest to adopt a tower sharing policy, and continues to make remarkable strides in shared infrastructure and high tower tenancy ratios, contributing to a move seven places up the ADI rankings.

Progress around setting efficient public rights of way has been mixed. New regulations in India require a single online point of application, guarantee a response within sixty days, and establish due process protections for infrastructure once it has been built. The Colombian regulator has used a combination of enforceable regulations and voluntary guidelines to make improvements across different levels of government. Other countries, however, continue to struggle in this area. In Brazil, the 2015 tower zoning permissions continue to encounter obstacles blocking their full implementation, including applications that remain continually stuck in judicial resolution; a desire for streamlined applications persists as a key item for attention among sector leaders within the country (as expressed in the 2017 Carta de Brasília, co-signed by Brazilian telecom leaders).

3.5Spectrum Management

Spectrum management has proven its importance in driving down data prices. A recent report from the GSMA details the impact that spectrum market manipulation can have on operators’ finances and in turn, the prices made available to consumers. As policymakers address this issue, the emphasis should be on transparent, accountable, and efficient allocation of spectrum to maximise the opportunity for major operators and community networks alike to expand internet access and provide reliable service.

Unlike the other policy areas in this report, where individual indicators broadly resemble the trajectory and growth trend of the subject area average score, the two indicators on spectrum management went in opposite directions. Overall, countries seem to have recognised the importance of timely spectrum management to meet market demand. This is especially true in the Asia-Pacific region, where the average score increased by over 26% between the 2017 and the 2018 reports.

In contrast, transparency around spectrum management and allocation dropped across the globe. In Latin America and the Caribbean, the regional average score on spectrum transparency dropped by over 13% from the 2017 report to the 2018 report. These discordant trajectories leave room for further research and analysis. However, with a focus on affordability, a number of examples are worth mentioning.

Since our 2017 report, a number of countries have released further details and plans around spectrum management. Countries in Southeast Asia have been particularly active on this issue. Indonesian authorities released details of a comprehensive spectrum roadmap with future demands as a key determining factor. Thailand (which moved into the top 10 countries on the ADI this year) continues to implement its 2015 spectrum master plan, with a particular effort around competitive auctions. While the auction process has not been without its complications, Thailand’s commitment to releasing more spectrum via public auction demonstrates policy progress with gradual steps towards making transparent standards more widespread. Similar progress is noted in Bangladesh with its successful 4G spectrum auction.

Highlights from Africa demonstrate the opportunity for leadership on spectrum policy, but also the real consequences of failing to address it. Tanzania improved on measures of spectrum transparency with the success of its first broadband spectrum auction (for the 700 MHz range). In a similarly positive step, Senegalese authorities included details about spectrum management and allocation within their new National Broadband Plan. South Africa, however, saw indicators on spectrum drop as regulators repeatedly fall short of moving spectrum to a competitive auction structure, and operators continue to report that constrained spectrum availability has limited their ability to roll out new networks.

4

How does geography impact affordability?

Progress across three years of the ADI has been noticeably slow — and particularly when it comes to measures of infrastructure. These infrastructure indicators include, among other factors, policies to simplify licencing frameworks, ensure transparent and timely spectrum allocation, facilitate efficient access to public rights of way, enable number portability, and increase the number of internet exchange points. Given the fact that all countries, on average, perform worse on infrastructure policy measures, we decided to examine in more detail the specific cost components that need to be addressed to overcome this infrastructure gap, particularly in countries with geographic or population characteristics that might make affordable access more challenging.

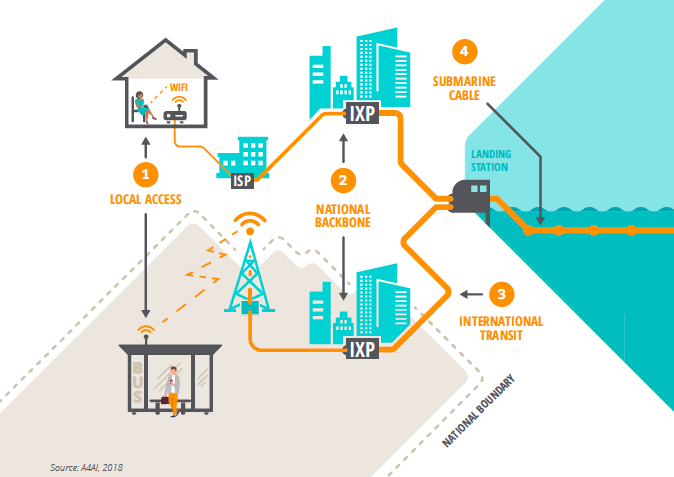

Geography and population size have a significant impact on the cost of providing internet access and, in turn, on the price that consumers must pay for access. The costs of internet service are borne by various actors, including internet backbone providers, who operate the core, high-capacity infrastructure connecting continents (e.g., submarine cables, landing stations, internet exchange points), and internet service providers, who pay to access the country’s international gateway and then build out the infrastructure across their country of operation (e.g., building towers, laying cables, leasing spectrum).

4.1The costs of bringing connectivity to your device

Four main components make up the bulk of broadband industry costs:

- Local access: This is the network through which the user accesses the internet. It can be provided through a fixed or wireless connection to the national network, but in the majority of cases in low- and middle-income countries, it is provided over a mobile network.

- National backbone: This is the link from the mobile access network to the international gateway or, for landlocked countries, the link to the national border along high-capacity cables within the country.

- International transit: In some instances, like in landlocked countries, there is no immediate access to an international gateway. In those cases, there is a need to purchase capacity on another country’s network to reach, for example, a submarine cable landing station.

- Submarine cable: Submarine cables are physical cables laid in the ocean, and are one method of providing international connectivity between countries. They are the main point through which the internet traffic of many countries will travel. Countries may therefore need to invest in cables landing on their coasts or lease part of the cable’s capacity from a neighboring country.

Figure 8. Industry cost components

4.2A country’s geography has a massive impact on the cost to connect

To examine how geographic and population factors impact the cost of internet access, we looked specifically at three types of countries:

- Small countries, either in population or surface area;

- Landlocked countries, especially those surrounded by other small or poor countries; and

- Island nations and archipelagos.

Using an approximation of the costs associated with the four primary cost components — (1) local access; (2) national backbone; (3) international transit; and (4) submarine cables — we estimated the overall costs in these different country types, in order to understand the extent to which the costs of internet access vary between different country types and the reasons for those variations.

As Figure 9 shows (below), the geographic and demographic factors discussed earlier have a significant impact on the costs found in different types of countries. While the average cost to provide an internet connection to each subscriber is around $20 per year, costs between countries vary between $5 and $54 — roughly a range of ±200%.

| Country type | Examples | Cost of Internet access in USD per subscriber p.a. |

|---|---|---|

| Large landlocked country with low population density | Bolivia, Laos, Zambia, Zimbabwe | 15.25 |

| Large landlocked country with high population density | Ethiopia, Uganda | 5.38 |

| Large coastal or island country with low population density | Brazil, Namibia, Peru | 19.68 |

| Large coastal or island country with high population density | Nigeria, Thailand | 7.66 |

| Small landlocked country with high population density | Burundi, Malawi | 6.78 |

| Small landlocked country with low population density | Bhutan, Lesotho, Swaziland | 29.15 |

| Island archipelago with low population density | Fiji, Samoa | 54.14 |

| Island archipelago with high population density | Philippines, Maldives | 35.2 |

| Small coastal or island country with low population density | Liberia, Timor Leste | 23.05 |

| Small coastal or island country with high population density | Sierre Leone, Sri Lanka | 11.13 |

| Average across all categories | 20.74 | |

| Source: A4AI, 2018 | ||

Small countries — either in population or in surface area — tend to encounter significantly higher internet costs, as they have the least opportunity to realise economies of scale. Similarly, countries with a low population density see increased fixed costs of network coverage and higher unit costs, as a result of the disproportionately higher per-user cost of the national backbone network.

Landlocked countries incur additional costs because of the need to lease international transit capacity; these countries must pay substantial international transit costs in order to connect, and may struggle to avoid paying premium prices if they do not have a choice of transit providers or a population size that allows them to benefit from potential economic scale.

Island nations and archipelagos suffer higher costs because they need to deploy submarine cables for both domestic and international services, and may require submarine cables to be installed within the country, thus increasing the cost of national backhaul. For example, the costs to provide mobile broadband access per subscriber (per annum) in an island archipelago with a high population density (e.g., the Philippines) can be 4.6 times higher than that of a large coastal country with a high population density (e.g., Nigeria).

4.3Mobile network & submarine cable are the biggest costs for industry

Figure 10, below, breaks down the total costs of internet access according to the four main components identified earlier.

| Country type | Examples | International internet capacity | International transit capacity | National internet backhaul capacity | Mobile broadband access | TOTAL |

|---|---|---|---|---|---|---|

| Large landlocked country with low population density | Bolivia, Laos, Zambia, Zimbabwe | 22% | 1% | 2% | 75% | 100% |

| Large landlocked country with high population density | Ethiopia, Uganda | 34% | 0% | 2% | 64% | 100% |

| Large coastal or island country with low population density | Brazil, Namibia, Peru | 29% | 0% | 5% | 66% | 100% |

| Large coastal or island country with high population density | Nigeria, Thailand | 33% | 0% | 1% | 66% | 100% |

| Small landlocked country with high population density | Burundi, Malawi | 31% | 0% | 3% | 66% | 100% |

| Small landlocked country with low population density | Bhutan, Lesotho, Swaziland | 30% | 1% | 4% | 65% | 100% |

| Island archipelago with low population density | Fiji, Samoa | 24% | 0% | 8% | 68% | 100% |

| Island archipelago with high population density | Philippines, Maldives | 36% | 0% | 27% | 37% | 100% |

| Small coastal or island country with low population density | Liberia, Timor Leste | 13% | 0% | 3% | 84% | 100% |

| Small coastal or island country with high population density | Sierre Leone, Sri Lanka | 33% | 0% | 2% | 66% | 100% |

| Average across all categories | 28.60% | 0.20% | 5.70% | 65.50% | 100% |

In virtually all cases, the most substantial cost component is the mobile network. This cost is particularly significant in a large country with low population density. Around 75% of the mobile network costcomes from the costs associated with providing data services over the network — a cost is likely to continue to increase as a result of the growth of data services and data traffic. Some of the main drivers of these costs for mobile networks include disproportionately high levels of taxation on the mobile sector, high infrastructure deployment costs, expensive access to power, and high spectrum fees.

Purchasing access to an international submarine cable which connects to the global internet backbone, represents the second largest industry cost, with substantial upfront investment required to gain access. In a typical submarine cable, each unit of capacity purchased costs 25% of the previous unit; this means that countries that can generate high traffic volumes — because of high population, high broadband take-up, or the implementation of policies and practices that stimulate demand — will benefit from lower unit costs. This market pressure inherently favours densely populated countries; small countries or sparsely populated countries inevitably spend more per capita on submarine cable access than highly populated countries. This situation calls for consideration of sub-regional approaches and partnerships to submarine cable access, such as those in place through the ACE cable consortium in West Africa, where capital costs were shared among the partners and with support of the World Bank.

In addition, there should be sufficient demand to drive the use of additional capacity. In Nigeria, where five cable systems now serve the market, the costs of submarine cable capacity have reduced considerably over the past ten years, with wholesale prices now approximately 1-2% of prices a decade ago. Despite these reductions in wholesale prices, consumer demand has not increased sufficiently to make use of the increased capacity, due to the limited reach of backbone and last-mile networks inland. As a result, the bandwidth consumption per user remains constrained since users are not able to access these higher levels of capacity without also incurring considerably higher costs.

In comparison with mobile broadband access and submarine cable capacity, the last two elements (international transit capacity and national backbone capacity) generally represent a much lower proportion of total internet access costs. International transit is a consideration for only landlocked countries, but even for those countries with low population density, these costs account for no more than 1% of total internet access costs. That said, international transit costs may become more significant as the volume of data traffic grows, pointing to the importance of local data caching, especially for smaller and rural operators.

National backbone costs are generally more significant, amounting to 6% of total internet costs on average, and can be quite substantial for larger countries with expansive geographies and for countries that have to deploy submarine cables as part of the national backbone network (e.g., island archipelagos).

It can be seen that, all else being equal, internet access is more expensive in:

- Countries with low population density – scale economies are far lower than in high-density countries of the same land area because the fixed costs of providing internet access are shared between fewer customers.

- Landlocked countries – the need for international transit links to a submarine cable landing station adds an additional cost compared to a coastal country that has its own landing station.

- Island archipelagos – the need for national submarine cable links between islands adds an additional cost compared to a mainland nation.

- Geographically large countries – scale economies are lower than in small countries with equal population because the national backhaul network is more expansive and costlier.

Geographic factors heavily influence the industry cost of internet access. Each connection to the internet requires technological cooperation among a range of different segments of the network and, in turn, among different companies. Governments can play a key role in supporting this cooperation by making sure policies incorporate the geographic and other considerations examined above, supporting regional cooperation, and bringing together stakeholders within the country to work toward affordable internet access. We detail how these can work in practice in the next section.

5

What are the policies needed to accelerate progress on the path to affordability?

Despite broad, international agreements for more affordable and universal access to the internet, prices remain too high for billions of people to afford to connect. Countries that defer on investment in internet access prolong the development process and miss out on the opportunity to reduce social and economic inequalities for the current generation. Affordable internet access can accelerate economic growth, fortify individual rights, and expand educational capacity for a country; but, to harness the internet’s potential, policymakers must first address the policy gaps in their country.

5.1Understand cost components for different geographies in order to reduce their impact.

Even though infrastructure costs may differ in line with differences in geography and population density, policymakers can take action to reduce the impact of these cost factors. In the Pacific Island nations, for example, the World Bank has offered interest-free loans for accessing submarine cables — a move that has greatly reduced the impact of this critical cost component. Similar investment loans have reduced the costs of national backbone networks in countries like Malawi and Tanzania. While these projects are positive examples of multilateral development bank (MDB) investment in expanding internet access, research shows that MDB investments in the ICT sector account for only 1% of their overall investments — a rate that falls far short of the estimated US$100 billion needed to achieve universal internet access in the next 10 years.

Across Southern Africa, where many poor countries are also landlocked, a regional initiative has been implemented to reduce the price of international transit and avoid exploitation by neighbouring countries that control the essential facilities of transit and access to the cable landing station. Indeed, regional agreements to establish fair interconnection and termination rates between operators in landlocked countries and their neighbours can help reduce costs. Countries that employ effective infrastructure sharing regimes and dig-once policies can reduce capital costs for operators and, in turn, create cost savings that lessen the economies of scale. It is precisely because of these possibilities that A4AI tracks progress towards good practices in policy and regulation that can lead to lower industry costs.

In addition to supply-side interventions, countries can implement policies that stimulate demand. Explicit subsidies on retail internet access, low taxes on infrastructure access and ICT services can help to keep costs low for users and encourage increased use. The cost of a mobile handset can represent one of the highest costs and biggest barriers to access for consumers, so subsidies or reduced tax rates on end-user devices can help to stimulate demand by reducing device costs. As volumes grow, unit costs will fall, and further savings will be enabled. This is a strategy that should be adopted by all low- and middle-income countries as they seek to improve internet affordability.

Policymakers will need to focus their attention on the market realities that make their context unique. Components of internet access that are unusually expensive in their country should be identified as key areas for intervention, and policymakers can adopt policies that help to reduce those costs (e.g. through public investment, targeted subsidies or tax breaks and incentives) in order to improve internet affordability for all. Geography influences, but does not exclusively determine, the cost of internet access and its affordability for users. With greater clarity on the cost elements associated with internet service provision, it is paramount that policymakers work with market players to address these challenges, incentivise smart investment, and stimulate demand.

5.2Focus on smart strategies, more public access points, and effective spectrum management.

Countries looking to catch up to their peers on affordability would be wise to consider the gaps in policy in their country and across their region and to prioritise their attention to those areas which have the most potential to impact positive change.

By comparing the performance of lower-middle and upper-middle income countries across the ADI policy clusters, we see where some of these policy gaps are. Perhaps unsurprisingly, countries with higher incomes and more affordable data perform better overall across the ADI.

However, there are several instances where countries with lower average incomes have achieved affordable broadband — ahead of countries with higher average incomes — by implementing effective policy change, particularly in broadband strategy, universal and public access, and spectrum management. Interestingly, this is also where the policy gaps within the two income groups are the greatest. This suggests that countries that establish a broadband strategy, invest in universal and public access, and effectively manage their spectrum see the reward of more affordable mobile broadband.

Figure 11. Average policy score, by income group and data affordability, ADI 2018

Comparing prices for mobile broadband over time against the policy changes countries have made in driving down prices, this report stresses three key policy interventions for countries with unaffordable broadband prices:

1. Adopt or update accountable and realistic National Broadband Plans.

- The most effective broadband policies provide the public and private sectors with clear guidance and a roadmap to sector development and support regulatory certainty.

- Effective public policies also set clear, transparent plans and targets to support network development and expand internet access over a wider geography and to a larger number of people, addressing market gaps that otherwise would likely be neglected.

2. Establish and implement effective Universal Service & Access Funds (USAFs).

- The effective use of USAFs can expand connectivity to the widest margins of society and curb the potential for technology to exacerbate pre-existing inequalities in the country.

- USAFs can be used to finance the expansion of infrastructure to underserved areas and population groups, and to increase individual access by, for example, subsidising end-user devices. Additionally, USAFs should be used to reduce the digital gender gap within countries as a step towards ensuring universal access.

3. Commit to effective spectrum allocation processes.

- Emphasis should be on transparent, accountable, timely, and efficient allocation of spectrum for existing internet service providers who serve various market segments and also non-traditional ISPs, such as community networks.

The world is far behind pace to reach universal, affordable internet access by 2020, but the decisions of policymakers between now and 2020 will determine if the benefits of affordable internet access will be pushed even further into the future.

Affordable internet access is neither a luxury nor an inevitable outcome. Chronic inaction on broadband policy has led to an underwhelming pace of change and missed targets on internet penetration. Policymakers must take an active role in supporting a strong policy and regulatory environment, setting broadband strategy, investing in universal and public access, facilitating infrastructure sharing, and managing spectrum. This report documents broadband policy leadership happening in each region of the world: we hope the next report will document renewed and robust leadership in each country.

6

Annex

6.1Acknowledgements

Research and analysis for the 2018 Affordability Report was led by Dhanaraj Thakur. The report was written by Teddy Woodhouse, Lauran Potter, and Dhanaraj Thakur. Sonia Jorge and Kristen Robinson provided valuable advice and contributions. David Rogerson of Incyte Consulting provided extensive analysis and support for the section on geography and industry costs.

The Affordability Drivers Index research was carried out by Siaka Lougue (African Institute for Mathematical Sciences). A wide range of experts were involved in the primary research conducted in June-August 2018: we thank them for their contribution.

We also thank the A4AI member organisations for their inputs and suggestions to the early drafts. Any errors in this report remain the authors’ alone.

Finally, we are grateful for the support of A4AI’s global sponsors — Sida and Google — and that of the Alliance’s entire membership.

Suggested citation

Alliance for Affordable Internet (2018). The 2018 Affordability Report. Washington DC: Web Foundation.

For media or other inquiries: press@webfoundation.org

6.2Methodology

As we continue to expand the scope of the index, this year we added three more countries to those assessed by the ADI. These are the Democratic Republic of the Congo, Guatemala, and Liberia. In total, 61 countries are now included in the index.

Constructing the ADI

The Affordability Drivers Index (ADI) is a composite measure that summarises in a single (average) number an assessment of the drivers of internet affordability in various countries. Benefiting from the research framework established by the Web Index, the ADI covers 61 countries and focuses on two key aspects driving affordability: communications infrastructure and access.

Two types of data are used in the construction of the Index: existing data from other data providers (‘secondary data’) and new data gathered via a multi-country expert researcher survey (‘primary data’).

The primary data consists of an expert survey. The survey includes questions — scored on a scale of 0–10 — on issues regarding policy, regulation, and various other aspects around broadband and affordable access to the internet. The questions were specifically designed by the Alliance for Affordable Internet, the Web Foundation, and its advisers. These primary data, based on and aligned with the A4AI Policy and Regulatory Good Practices, attempt to assess the extent to which countries have achieved a policy and regulatory environment that reflects the best practice outcomes. Survey questions were scored based on predetermined criteria by country experts. On average two experts per country were asked to provide evidence and justification that supports each score. The scores were checked and verified by a number of peer and regional reviewers.

This year, we conducted a new round of policy surveys on the 61 countries covered by the ADI. The surveys were conducted in between June and August 2018 by regional policy experts and included a peer-review process to improve the accuracy of the results. The surveys consist of the primary indicators making up the ADI, which are linked to A4AI’s good practices and policies to lower the overall cost structure for broadband. The 2018 surveys updated the results of our 2016 surveys and assess government policies during that two year period.

In addition, we draw on a range of secondary indicators to derive the sub-indices described above as well as the final composite index.

Data sources and data providers

We employed data from several large international databases to measure or proxy the dimensions under study. Before an indicator is included in the Index, it needs to fulfil four basic criteria:

- Data providers have to be credible and reliable organisations, which are likely to continue to produce these data (i.e., it is not a one-off dataset publication).

- Data releases should be regular, with new data released at least every three years.

There should be at least two data years for each indicator, so that a basic statistical inference could be made. - The latest data year should be no older than three years back from publication year.

- The data source should cover at least two-thirds of the sample of countries, so that possible bias — introduced by having a large number of indicators from one source that systematically does not cover one-third or more of the countries — is reduced.

All the indicators included in the ADI are listed below, where they are grouped by sub-index and type (primary sources or secondary sources). There are two distinct types of indicators: primary and secondary. The primary indicators (codes A1-A14) are collected via the policy surveys described earlier. The secondary sources included data collected by the ITU, GSMA Intelligence, and the World Bank.

The indicators used in the ADI represent a comprehensive set of factors that influence broadband affordability. However, this is not a complete list as there may be other important factors which cannot be included because they do not meet the criteria above. In such cases, we conduct supplementary analyses to the index as we have done in past by looking at income and gender equality.

The factors that the ADI covers are grouped into two sub-indices — infrastructure and access:

- The infrastructure sub-index measures the current extent of infrastructure deployment and operations, alongside the policy and regulatory frameworks in place to incentivise and enable cost-effective investment in future infrastructure expansion. Variables included in this sub-index include, for example, the amount of international bandwidth available in a particular country, and an assessment of a nation’s spectrum policy.

- The access sub-index measures current broadband adoption rates and the policy and regulatory frameworks in place to encourage growth and ensure provision of affordable and equitable access.This sub-index includes variables such as current internet penetration rates and an assessment of the effectiveness of a country’s Universal Service and Access Funds.

| Type (Code) | Access Sub-index Indicators |

|---|---|

| Primary (A5) | Clear, time-bound targets in National Broadband Plan for reducing cost & increasing penetration |

| Primary (A12) | USAFs used to subsidise access for under-served and underprivileged populations |

| Primary (A4) | ICT regulatory decisions informed by adequate evidence |

| Primary (A13) | Specific policies to promote free or low-cost access |

| Primary (A11) | To what extent have Universal Access/Service Funds (USF) prioritised infrastructure investments that will reduce costs and increase access for under-served communities and market segments? |

| Primary (A2) | To what extent does the gov’t ICT regulator perform its functions according to published and transparent rules, with the ICT regulatory decisions influenced by public consultations? |

| Primary (A14) | To what extent do the country’s broadband policies include strategies and programs to improve access and use among women and girls. |

| Secondary (WI) | Market Concentration - Herfindahl Index (HHI) |

| Secondary (ITU_K) | Existence of National Broadband Plan |

| Secondary (WI_C) | Mobile broadband connections (% of all connections) |

| Secondary (ITU_EYE) | Cluster of ITU indicators (bundled) |

| Secondary (ITU_N) | Percentage of individuals using the Internet |

| Secondary (Mobile_penet) | Market penetration - Mobile internet unique subscribers |

| Secondary (Smart_Phadpt) | Smartphone - adoption |

| Type (Code) | Infrastructure Sub-index Indicators |

| Primary (A1) | Flexible, technology & service neutral ICT licensing frameworks |

| Primary (A8) | Specific guidelines for public infrastructure funding & telecoms subsidies |

| Primary (A9) | Time bound gov’t plan to make available broadband spectrum for high-speed data services |

| Primary (A10) | Transparent, competitive and fair process for increasing spectrum availability |

| Primary (A3) | To what extent does the regulator and/or the competition commission enforce the country's ICT licensing requirements and regulations? |

| Primary (A6) | National policies in place facilitating efficient access to public rights of way & tower zoning permissions |

| Primary (A7) | To what extent does the government facilitate resource sharing across telecommunications operators? |

| Secondary (ITU_A) | International bandwidth per Internet user (bits/s) |

| Secondary (ITU_L) | Investment per telecom subscriber (average over 3 years) |

| Secondary (WB_A) | Secure Internet servers (per 1 million people) |

| Secondary (IEAA) | Electrification Rate |

| Secondary (PCH) | Existence of Internet Exchange Points (IXPs) |

| Secondary (ITU_EYEbn) | Existence of Number portability between mobile network operators |

| Secondary (3G) | 3G Network coverage, by population |

Index Computation

There are several steps in the process of constructing a composite index. Some of those involve deciding which statistical method to use in the normalisation and aggregation processes. In arriving at that decision, we took into account several factors, including the purpose of the Index, the number of dimensions we were aggregating, and the ease of disseminating and communicating it in an understandable, replicable, and transparent way.

The following seven steps summarise the computation process of the Affordability Drivers Index:

- Take the data for each indicator from the data source for the 88 countries covered by the Web Index for the 2007-2017 time period. Impute missing data for every secondary indicator for the sample of 88 countries over the period 2007-2017. Some indicators were not imputed, as it was not logical to do so. None of the primary data indicators were imputed. Hence, the 2018 Affordability Drivers Index is very different from the 2007-2017 Indexes that may be computed using secondary data only. Broadly, the imputation of missing data was done using two methods, in addition to extrapolation: country-mean substitution if the missing number is in the middle year (e.g., have data for 2009 and 2011, but not for 2010), or taking arithmetic average growth rates on a year-by-year basis. For the indicators that did not cover a particular country in any of the years, no imputation was done for that country/indicator.

- Normalise the full (imputed) dataset using z-scores (z=(x-mean)/standard deviation), making sure that for all indicators, a high value is ‘good’ and a low value is ‘bad’.

- Where applicable, cluster some of the variables (as per the scheme in the tree diagram), taking the average of the clustered indicators post-normalisation. For the clustered indicators, this clustered value is the one to be used in the computation of the Index components.

- Compute the two sub-index scores using arithmetic means, using the clustered values where relevant.

- Compute the min-max values for each z-score value of the sub-indices, as this is what will be shown in the visualisation tool and other publications containing the sub-index values (generally, it is easier to understand a min-max number in the range of 0 – 100 rather than a standard deviation-based number). The formula for this is: [(x –min)/(max – min)]*100.

- Compute overall composite scores by averaging the sub-Indexes (at z-score level).

- Compute the min-max values (on a scale of 0-100) for each z-score value of the overall composite scores, as this is what will be shown in the visualisation tool and other publications containing the composite scores.

Changes in this year’s ADI

Given the need to ensure that the report and the ADI are effectively supporting A4AI’s policy advocacy goals, it is important to conduct periodic reviews of the report, the ADI, and its methodology. To support this effort, A4AI convened a committee of experts to propose recommendations on revising and updating the Index. This group consisted of experts in telecommunications policy and reform from industry, governmental organisations, international aid agencies, civil society, and academia. Based on these suggestions, we also conducted an internal assessment of the ADI with the aim of improving it. The discussions with the committee and subsequent assessments took place between August and December 2017. The following tables (5B and 5C) summarize the proposed changes and decisions taken.

| New Variable (and source) | Rationale |

|---|---|

|

Number portability (Source - ITU ICT EYE: "number portability required from mobile operators" (binary variable: yes/no) Decision: Add variable to ADI |

An important indicator of the degree of consumer choice in the market, and by extension level of competition. Also, it has a moderately weak (r=-0.33) and statistically significant correlation (p<0.018) with affordability (price/income). |

|

"Network coverage, by population 3G" (Source: GSMA Intelligence) Decision: Add variable to ADI |

Currently the index uses the variable “Percentage of population covered by mobile cellular network” (source ITU). Given the focus of the ADI, including mobile broadband coverage is more appropriate. Also, it has a moderately strong (r=-0.6) and statistically significant correlation (p<0.000) with affordability (price/income). |

|

Gender responsive broadband/ICT policy (assessment on scale of 1 to 10; source: A4AI expert policy survey) Decision: Add variable to ADI |

Given the large gender gap in internet use globally, and the fact that a lack of affordability is one of the major obstacles to improving use among women, it is important to assess how governments are addressing this obstacle. Note this question was included in the last round of A4AI’s expert policy surveys (2016), but not included in the ADI itself. It was used in a separate report on gender responsive broadband policies. |

|

"Market penetration, unique subscribers - Mobile internet" (Source GSMA Intelligence) Decision: Add variable to ADI |

Currently the index uses the variable “Unique mobile subscribers/100 persons” (source GSMA Intelligence). Given the focus of the ADI, including mobile Internet subscribers is more appropriate. Also, it has a moderately strong (r=-0.43) and statistically significant correlation (p<0.001) with affordability (price/income). |

|

"Handset_500MB; prepaid; Speed; in Mbit/s" (Source ITU World Telecoms Indicators Database) Decision: Do not add variable to ADI |

Currently the index uses the variable “Fixed broadband speed (Average Mbps)” (source ITU). Given the focus of the ADI, including mobile broadband speeds is more appropriate. Also, it has a moderately weak (r=-0.27) and statistically significant correlation (at the 5% level: p<0.035) with affordability (price/income). Unfortunately, the available data covers only a few countries in the ADI. |

|

"Smartphone - adoption" - (Source GSMA Intelligence) Decision: Add variable to ADI |